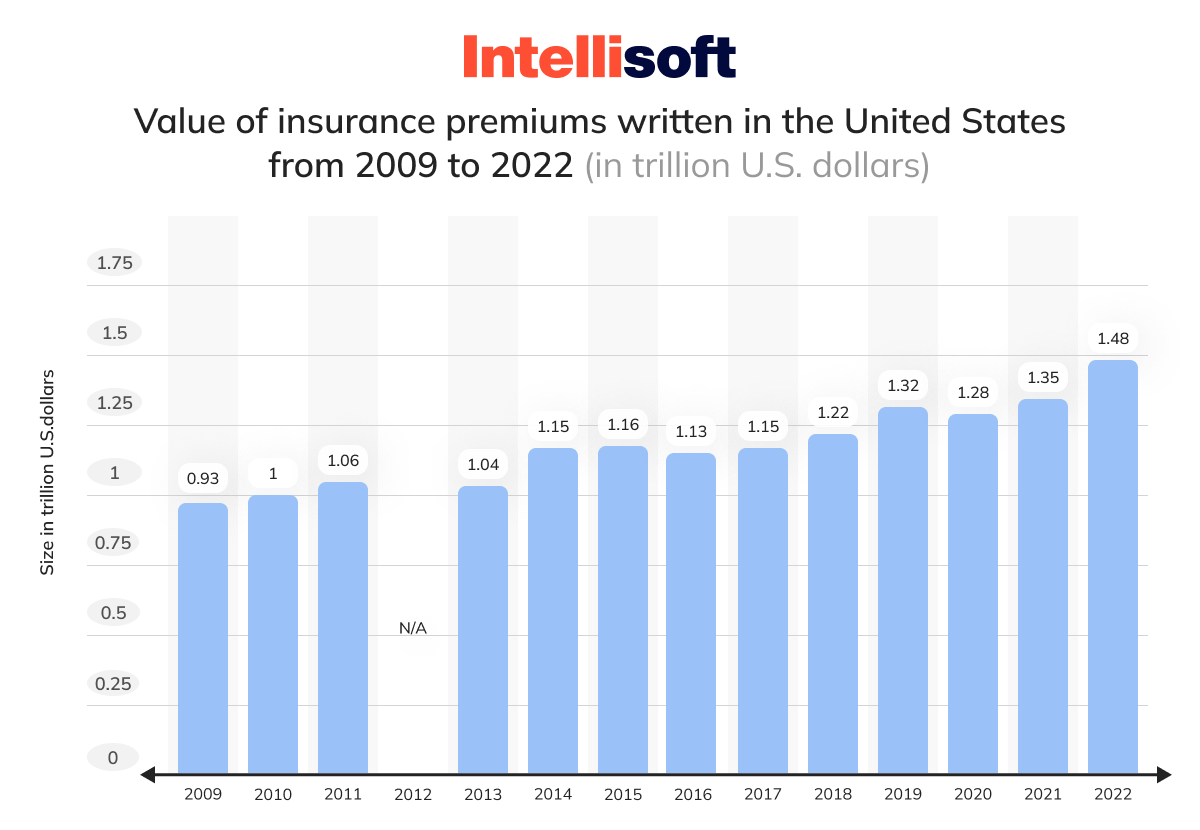

The insurance industry in the United States is extensive and complex, with annual net premiums exceeding $1.48 trillion. This fact creates very high stakes and the need for insurance automation. Numerous detailed and complicated processes behind the scenes pose challenges even to the most efficient systems. As the number of clients and volume of data increase, the bureaucratic workload also grows, which can lead to expensive mistakes and employee burnout.

IntelliSoft is here to help you navigate through this complex environment. We specialize in creating state-of-the-art management software for different industries. Our solutions are designed to automate and streamline your insurance processes. This article will explain how you can lessen the burden of manual tasks and improve your agency’s efficiency. Embracing automation is essential. It is not merely a convenience but a necessity to remain competitive in the fast-moving insurance market.

Table of Contents

What is Insurance Automation Software?

Insurance automation software streamlines a wide range of daily activities within the insurance sector, covering areas from marketing and sales to policy renewals. This technology is crafted to handle various key operations efficiently. Its tasks include generating and presenting quotes, responding to customer inquiries, automating sales and marketing efforts, managing call center operations, conducting investment accounting, issuing and renewing policies, sending bills and statements, making payments, and managing claims.

By automating these critical tasks, productivity can soar. Deloitte’s study shows a 68% productivity increase at a top insurance company after adopting basic automation.

Sales Process Automation

Automating the sales process in insurance is crucial for enhancing how policies are distributed across numerous channels such as digital platforms, bancassurance, and through agencies, brokers, agents, and call centers. This automation boosts efficiency in several sales tasks. For instance, straight-through processing (STP) enables seamless direct or online sales.

Automated lead management includes functions such as generating, storing, distributing leads, removing duplicates, tracking activities, and sending reminders to sales reps. Other features support opportunity management for identifying cross-selling and upselling prospects, provide a dedicated app for field sales reps, facilitate online customer verification through video KYC, streamline agent onboarding, and integrate call center management for larger operations.

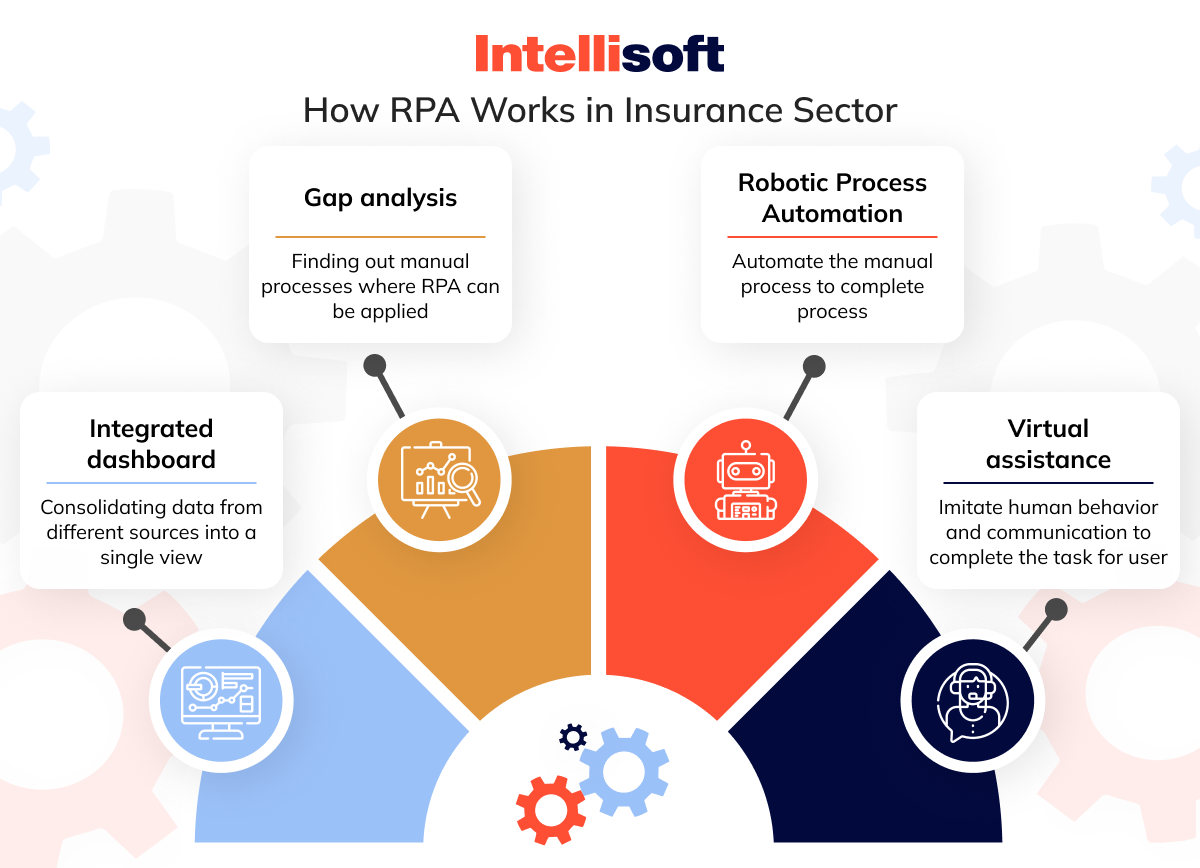

Robotic Process Automation in Insurance Industry

Robotic Process Automation (RPA) targets automating routine and unvarying rule-based tasks. Robotic process automation in insurance industry is applied in underwriting, pricing, claims processing, business and process analytics, customer onboarding, policy management, and client services. Software solutions such as Better Agency, Agency Engine, Insurance Noodle, and Ebix use RPA in insurance claims processing, which helps automate these repetitive tasks, enhances accuracy by reducing human errors, and keeps detailed records of all activities and changes, thus robustly supporting complex business operations.

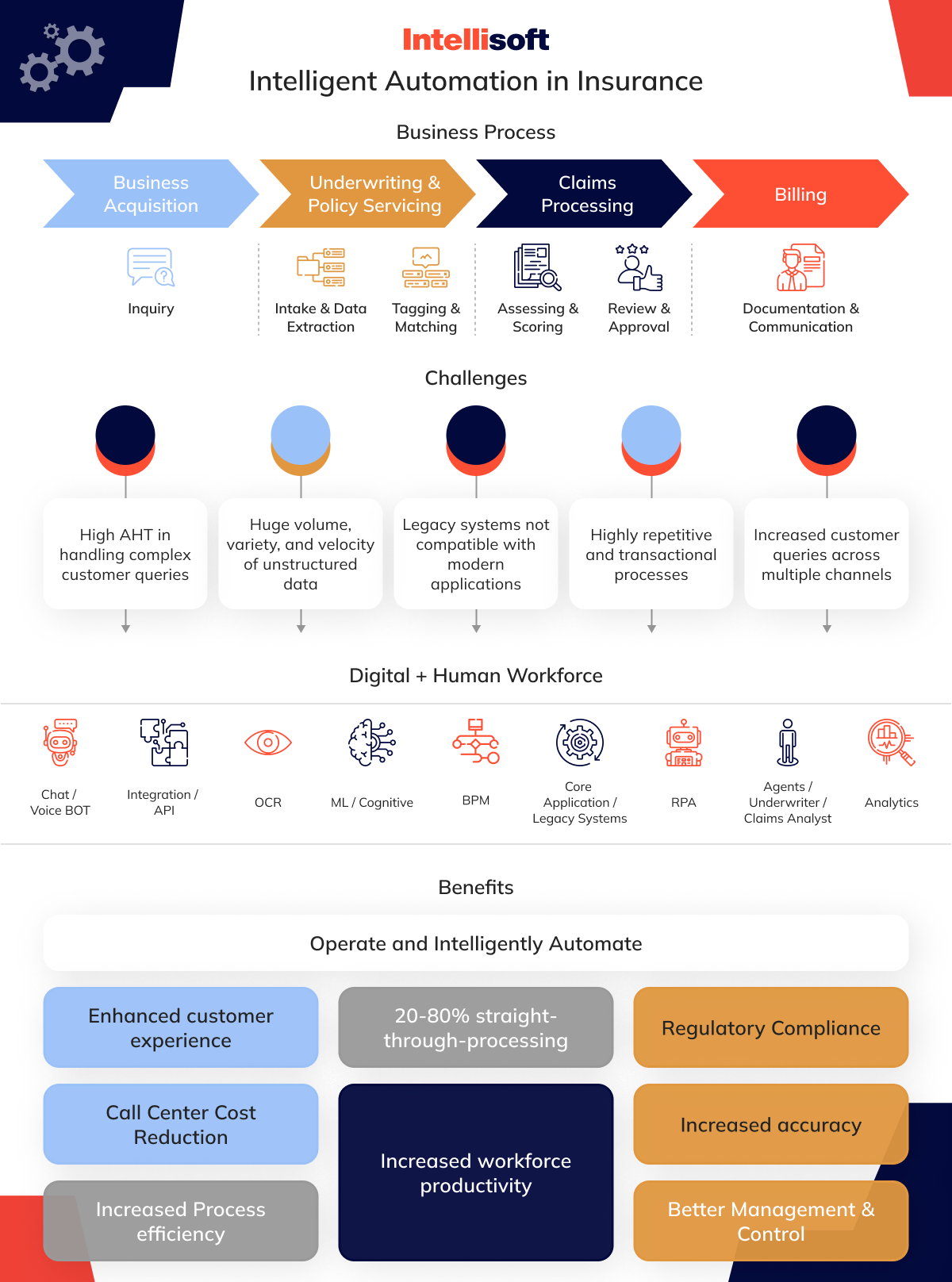

Intelligent Automation

Intelligent automation (IA) becomes vital when dealing with large amounts of unstructured data or adapting to frequently changing scenarios, such as shifts in customer demands or regulatory changes. IA merges robotic process automation in life insurance capabilities with advanced technologies such as computer vision, text analytics, natural language processing (NLP), and machine learning. These technologies help manage unstructured data and facilitate predictive analytics for informed decision-making and optimizing key performance indicators (KPIs).

IA also includes machine learning algorithms that enable bots, like chatbots, to learn from user interactions and improve over time. While still evolving within the insurance industry, IA’s potential to transform industry practices is significant, with pioneers like Indico, Cortex, and Mindtree leading advancements.

Through its various facets, such as sales process automation, RPA in life insurance, and intelligent automation, insurance automation software fundamentally reshapes how insurance companies operate, promising a future where efficiency, accuracy, and customer satisfaction are significantly enhanced.

Why Use Insurance Automation Software?

RPA in insurance industry software is a game-changer in the insurance industry. It tackles numerous operational challenges and significantly enhances efficiency across various business processes.

Faster Document Processing

In insurance, something as straightforward as a quote request can involve a complex sequence of tasks across multiple data points. Insurance automation software simplifies this complexity by enabling fast data extraction and automating every step of the document processing journey.

This technology not only accelerates the process of notifying customers about their requests but also improves customer interactions through self-service portals. These portals allow customers to access their information instantly, solve problems independently, or seek help when needed. Additionally, automation minimizes common errors and duplications in manual paperwork, leading to more reliable and precise data management.

Sales and Marketing Automation

Insurance companies consistently strive to personalize customer experiences despite the inherent complexities of marketing campaigns, including landing pages, sign-up forms, emails, and calls to action (CTAs). Automation software streamlines these complex workflows, facilitating better communication between marketing and sales teams and customers. This collaboration improves customer interactions and enables more targeted, meaningful marketing strategies, ultimately boosting customer engagement and satisfaction.

Simplified Compliance Processes

As regulatory landscapes such as HIPAA and PCI DSS evolve, maintaining compliance becomes increasingly critical for insurance companies. Automation software is vital in this area, generating automatic logs for every process to help maintain precise records and minimize human error. Its ability to quickly adapt rules and procedures in response to new or updated regulations ensures that companies stay compliant, thus avoiding potential legal and financial repercussions.

Boosting Customer Service

Automation drastically reduces the time agents spend on administrative tasks, allowing them to focus more on direct client interactions. This shift enhances customer service quality and speeds up the entire process, from initial contact to finalizing deals. Improved efficiency results in higher revenue and better returns as agents can manage more clients and resolve inquiries faster, enhancing the overall customer experience and strengthening client relationships.

Underwriting

Underwriting significantly benefits from automation. Traditionally, underwriting involves gathering and analyzing data from various sources to assess and manage policy-related risks. Automation streamlines this process by efficiently collecting and extracting relevant data, pre-populating fields, and analyzing historical data.

These capabilities enable quicker and more precise risk assessments and decisions on policy premiums based on comprehensive, real-time insights. By reducing the time required to connect various data points and draw conclusions, RPA in insurance underwriting ensures that decisions are rapid and informed.

Adopting insurance automation software streamlines operations and greatly enhances efficiency, compliance, customer service, and underwriting accuracy. It is an essential tool for modern insurance firms that aim to remain competitive and agile.

Related readings:

- Step-by-Step Guide to Integrating a Paperless Document Management System

- Time-Saving Success: Crafting the Perfect Scheduling App from Concept to Launch

- How To Build A Software From Scratch That Meets Your Goals?

- App Development Costs Breakdown: How to Estimate Expenses for Your Next App Project

- Making Sense of Databases: How to Choose the Right One

Health Insurance Software Solutions Examples

The health insurance industry has seen significant advancements with the introduction of specialized software solutions to boost operational efficiency and enhance the experience for providers and clients. Below are several notable robotic process automation use cases in insurance healthcare applications that have become popular due to their innovative features and practical benefits.

Cigna

Cigna is recognized as a comprehensive digital health platform designed to help individuals find appropriate health insurance plans. It’s highly adaptable, offering specialized modules for different user groups, including brokers, employers, Medicare participants, and healthcare providers. A standout feature of Cigna is its ability to assist users in checking coverage details for specific medications or treatments and enabling easy communication with doctors within the network. This functionality ensures policyholders fully understand and utilize their benefits effectively.

Oscar Health

Oscar Health is specifically tailored for the U.S. market and focuses on finding and enrolling in the right health insurance plan as straightforward as possible. It prioritizes patient engagement by facilitating easy access to healthcare providers, fostering a seamless connection between patients and their doctors. Oscar Health is praised for its user-friendly interface and role in simplifying the often complicated insurance enrollment process.

AgencySmart

AgencySmart is a cloud-based platform that supports insurance agents and brokers by automating customer relationship tasks and insurance management tasks. In addition to its primary functions as a Customer Relationship Management (CRM) tool, it also integrates aspects of financial software. This dual functionality makes it an effective tool for managing various insurance and financial operations, helping agents and brokers streamline their workflows.

Agency Advantage

Agency Advantage provides a powerful solution for independent insurance agents, boosting their ability to efficiently manage documents, RPA in insurance claims, and insurance policies. The platform facilitates the quick issuance of quotes and estimates, significantly easing the administrative load on agents. This management solution is particularly valuable for increasing the operational efficiency of independent agents in the insurance sector.

Plexis

Plexis focuses on claims management within the healthcare insurance arena. It is one of the most fitting RPA use cases in insurance. Plexis automates many administrative tasks for healthcare providers, thus enhancing the accuracy and speed of service delivery. Plexis stands out for its effectiveness in simplifying complex claims processes, which are often challenging without RPA in healthcare insurance.

iNube

iNube is a web and mobile platform designed for brokers, offering a digitized solution that improves the user experience for both brokers and their clients. By harnessing digital technology, iNube enables more efficient and engaging interactions between brokers and clients, addressing a range of needs within the insurance industry.

These RPA in insurance use cases demonstrate the varied applications of digital technology in transforming the insurance landscape. They make operations more efficient and user-friendly while meeting the specific requirements of different stakeholders in the health insurance sector.

How to Develop Insurance Automation Software with IntelliSoft?

Developing effective insurance automation software involves a sophisticated blend of technical skill and strategic foresight. At IntelliSoft, we simplify this process into three key steps to ensure that the resulting tool enhances operational efficiencies and aligns perfectly with your business objectives.

Step 1. Define Your Insurtech Strategy and Business Goals

The first and most critical step in creating impactful insurance software is to define precisely what you want to achieve. Your goals could range from improving customer service through a specific solution to implementing a comprehensive system that manages all aspects of insurance operations and transactions.

It is essential to understand and articulate your goals clearly, be it reducing operational costs, boosting customer loyalty, or enabling mobile management of all insurance-related activities. This clarity helps developers craft software that directly addresses your needs.

Step 2. Choose the Insurtech Software Type

Various types of insurance software are available, each designed to tackle specific operational challenges. For instance, if your goal is to enhance lead management and customer communications, a CRM-based solution might be the best fit. Alternatively, opting for a cloud-based system could be more beneficial if you want to expedite document processing and simplify the application procedures.

At IntelliSoft, we understand that no single solution fits all scenarios, so we often recommend a hybrid approach. This method combines elements from different software types to create a comprehensive solution that thoroughly meets all your needs.

Step 3. Pick the Development Approach

Choosing the right development approach is vital as it significantly impacts the software’s quality, effectiveness, and ultimate success. Here are a few options:

Hiring a Freelance Development Team

This option can be cost-effective but may involve risks such as quality and communication issues.

Building the Solution In-House

This approach is suitable if you have a capable development team with expertise in ML, RPA and AI in insurance, APIs, microservices, and programming languages such as Python, Java, and Scala. It demands a robust understanding of both technology and the insurance sector.

Hiring an Experienced Software Development Company

Partnering with a company like IntelliSoft is often the safest and most reliable choice. It ensures high-quality product design tailored to your specific requirements. Our team enhances the product proactively during the pre-development phase, aligning it closely with your business goals to save time and reduce costs.

Choosing IntelliSoft also means selecting an engagement model that suits your budget while ensuring a smooth and efficient development process with minimal oversight. Partnering with IntelliSoft for your insurance automation software development allows you to leverage our expertise in creating solutions that are technically sound but also strategically poised to enhance your competitive edge in the industry.

Best Practices in Insurtech Development

At IntelliSoft, we adhere to a set of best practices in the development of insurance software that ensure our projects are not only successful upon launch but continue to provide value as they evolve. Here are some critical strategies that guide our development process:

Sandbox Testing

To guarantee robustness and reliability, sandbox testing is essential in the development of insurtech software. This method allows developers to deploy new software modules and test them against anonymized data sets to evaluate system performance under various conditions.

By maintaining a separate testing environment, we enable the ideation, iteration, and rapid testing of new features without jeopardizing mission-critical data and operational processes. This secure approach ensures that both customer data and operational integrity are protected, allowing for innovation without risk.

Scalability from the Start

Scalability is a fundamental consideration in the design and development of any insurance automation platform. At IntelliSoft, we begin every project with a clear framework that outlines initial features, stakeholder responsibilities, success metrics, and decision-making criteria. This proactive planning ensures that the insurance automation system can scale in tandem with the business, driving continued value and avoiding becoming a bottleneck as user demands and data volumes grow.

Our forward-thinking approach in planning product architecture means that scaling up or down can be achieved effortlessly without the need for extensive code refactoring or significant product modifications.

Third-party Service Integration

In the highly interconnected digital landscape, APIs and third-party integrations are crucial for building scalable and versatile insurance solutions. Taking inspiration from the open banking model, we embrace an open insurance approach, allowing data to flow freely through secure APIs rather than being siloed. This flexibility enables insurance providers to quickly adapt to market changes and integrate new data sources as needed.

For instance, with the rising consumer concerns about climate change, insurance companies have had to pivot quickly to incorporate new types of data into their decision-making processes. Open APIs facilitate these adjustments by allowing seamless integration with external data providers, keeping insurance companies agile and competitive in a rapidly evolving market.

By following these best practices, IntelliSoft ensures that our insurance solutions can meet our clients’ current needs and are poised for future growth and adaptability.

Insurance Automation Costs

Understanding the costs involved in developing and implementing a custom RPA in insurance sector solution is key to effective planning and budgeting. The financial investment required can vary significantly, influenced by several factors such as the complexity of the processes automated, the technologies used, and the scale of integration.

Factors Influencing Cost

Scope of Automation

The costs escalate with the number and complexity of the insurance processes you decide to automate, like RPA in insurance underwriting, billing, and claims management. Each process introduces additional customization requirements, which can inflate expenses.

Functional Complexity

Integrating advanced technologies, such as blockchain for secure transactions, adds to the overall cost. The more sophisticated the functionalities, such as real-time data analysis or automated risk assessments, the higher the development costs.

System Requirements

Important features like performance, availability, scalability, security, and compliance play a critical role in crafting a robust automation system. Adhering to high standards in these areas generally results in more complex and costlier solutions.

Integration Complexity

The extent and complexity of integrating the new system with existing platforms or third-party services also contribute to higher costs. More integrations require additional time and resources for successful implementation.

User Roles

The number of user roles and the intricacy of the permissions and interfaces designed for each role impact the development effort and associated costs.

Sourcing Model and Team Composition

The choice between full outsourcing, team augmentation, or in-house development affects costs. Outsourcing or augmenting from regions with lower labor costs, such as Eastern Europe, where rates are typically $30-50 per hour, can offer cost savings.

Cost Estimates

The cost of implementing an insurance automation system can range significantly:

Upper-Midsize Companies

Projects may cost between $200,000 and $1,500,000, depending on the scope and complexity of the features and integrations.

Large Enterprises

For companies with more intricate needs and processes, investments can range from $1,000,000 to over $4,000,000.

Development Timelines and MVP Considerations

Developing a minimal viable product (MVP) with essential features typically requires about 1,600 hours or roughly 200 working days. This approach allows businesses to scale their solution by gradually adding features post-deployment based on initial feedback and further needs. This strategy not only helps manage costs effectively over time but also facilitates feedback-driven improvements.

Although the upfront costs might appear substantial, the long-term RPA benefit in insurance, such as streamlined operations, reduced error rates, and improved customer satisfaction, always justify the investment in insurance automation. Companies are advised to weigh both their immediate and projected long-term needs when budgeting for an automation solution.

Conclusion

Insuretech, once viewed with some skepticism as merely a trend, has undeniably demonstrated its value in today’s technology-driven landscape. With advancements such as AI and blockchain, the insurance industry is experiencing profound transformations. Companies that ignore these changes risk falling behind in a fiercely competitive environment.

To excel in this evolving landscape, here are four key strategies for new insurance automation developers:

Prioritize the Digital-Savvy Consumer

Today’s market demands more than just operational efficiency; customer satisfaction has become a critical measure of success. It’s vital to gather and analyze consumer data, using these insights to continuously refine products to meet consumer expectations. Ensuring customer satisfaction is an ongoing effort that can significantly impact your company’s success.

Ensure Robust Security Measures

Security must be a top priority from the outset. Protecting personal data is crucial as breaches can damage your reputation and lead to severe legal consequences. Implementing stringent security measures is essential to protect user data and maintain consumer trust.

Focus on Quality Over Quantity

It can be tempting to pack your product with numerous features, but maintaining simplicity and quality is key. As Benjamin Tacquet, CTO of MoneyPark, suggests, it is often better to “do less, but better.” Concentrate on developing core functionalities that provide real value and perfecting them to distinguish your product in the market.

Act Without Delay

The pace of digitization in insurance is quickening. Postponing digital transformation initiatives can reduce your company’s ability to compete effectively. Now is the time to act to ensure your business remains relevant and progressive.

Partnering with an experienced and dependable development team is crucial for navigating these challenges. At IntelliSoft, we bring over a decade of experience in developing leading-edge solutions. Our enduring partnerships with industry leaders underscore our dedication to excellence and innovation.

If you’re poised to transform your insurance services with tailored software solutions, IntelliSoft is here to support you every step of the way. Let’s collaborate to develop technology that not only meets today’s market demands but also anticipates future trends.