The global fintech market is poised to hit an impressive $882.30 billion by 2030. With such explosive potential, it’s no wonder fintech is generating so much buzz—everyone needs a modern way to manage their finances and needs to estimate the fintech app development cost.

What’s particularly interesting is that 96% of millennials are already handling their money online, according to a survey by the Center for Generational Kinetics. Yet, despite this, Facebook IQ’s research indicates that only 36% of them have ever tried a fintech app. This gap highlights a huge opportunity for innovative new solutions.

If you want to learn how to build a Fintech app, you’ve come to the right place. At IntelliSoft, we have been working in the app development sector for more than 15 years, witnessing it grow and evolve, adapting to changing demands and utilizing the latest technology as it appeared on the digital horizon. We have developed all kinds of FinTech apps, all different in price, and now we know precisely what factors can influence the final FinTech app development price.

We’ll guide you through the key steps in FinTech app development, blending creativity with technical expertise to help you establish your presence in the dynamic world of financial technology.

Table of Contents

FinTech Market Overview

FinTech technology has not yet reached its peak development stage; it is still growing and will continue to evolve in the coming years. The FinTech market share is expected to reach $699.50 billion by 2030, with the number of digital banking users rising to 217 million in 2025.

The FinTech market has seen notable growth since the last global financial crisis, with increased investments driven by technological responses to challenges in traditional financial services. The recent COVID-19 pandemic further accelerated FinTech development, responding to economic impacts and recession with innovation.

Recently, various FinTech sectors, like Insurtech and payment services, have emerged, using advanced technologies for specific functions. Now that FinTech is more than just a trend, organizations are increasingly adopting technologies such as Blockchain and data analytics for greater efficiency and accuracy.

Still, the FinTech industry faces challenges that often slow down the adoption of new technologies and approaches. These challenges include:

- Compliance with government regulations

- Challenges of AI integration

- Lack of trust in financial companies

What is a FinTech App?

You have probably either used an app to make a budget, split a check with Venmo, sent money to your friend using a banking app, or bought cryptocurrency at least once. All of these are examples of FinTech applications that allow users to access and manage their finances online or make transactions easily. With FinTech revolutionizing the financial industry, the number of FinTech apps is growing as well, attracting more and more investment and attention.

In its essence, a FinTech app is a type of software solution built for automating and digitizing financial operations. These apps combine the latest technology and finance to improve people’s access to financial services and become more popular than traditional financial institutions.

Developing a FinTech app is crucial for staying competitive in the rapidly evolving financial landscape, offering users convenient and efficient ways to manage their finances, make transactions, and access a range of financial services anytime, anywhere. It enables businesses to meet the growing demand for digital financial solutions, enhance customer experience, and stay at the forefront of the FinTech industry.

FinTech app development presents several advantages over traditional financial services, contributing to its widespread adoption. These benefits encompass:

- Greater Accessibility. FinTech applications streamline the account opening process, requiring only internet access for users to sign up and access financial services such as payments, loans, insurance, and trading.

- Cost Reduction. As digital products, FinTechs eliminate brick-and-mortar costs, enabling them to provide clients with lower fees compared to traditional banks.

- Improved Financial Operations. FinTech apps empower users to manage their finances conveniently through smartphones or tablets, saving time and expediting financial transactions, including payments and credit approvals.

- Wide Range of Solutions. FinTech applications offer a diverse array of services, from digital payments and insurance to investing and financial advisory assistance. Many apps consolidate multiple services, facilitating various financial transactions within a single platform.

- Personalization. Leveraging FinTech technologies, these applications efficiently gather and process user data, enabling the delivery of personalized services that align with individual financial goals and capabilities.

Types of Fintech Apps

In recent years, the FinTech ecosystem of different app types has expanded due to growing investments and user demand. Currently, the ecosystem consists of:

Insurance apps

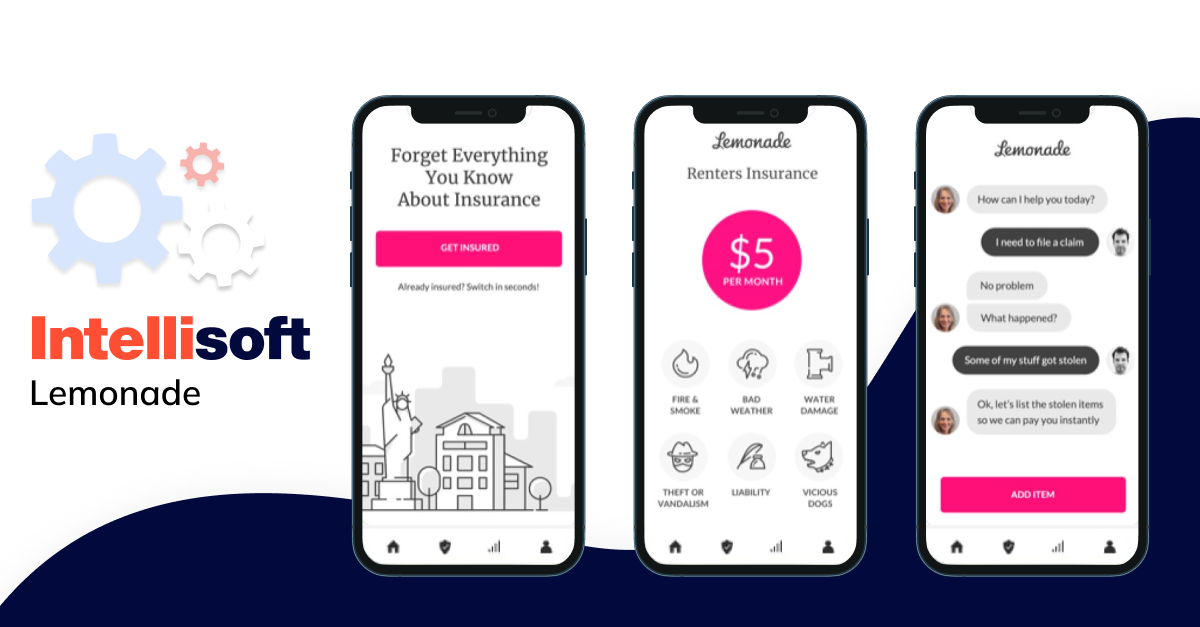

Example: Lemonade

Insurance apps have redefined the insurance experience by leveraging technology to streamline processes. These apps often employ artificial intelligence (AI) algorithms to assess risk, provide quick policy quotes, and offer a seamless claims process. Lemonade, for instance, uses AI and chatbots to enhance the efficiency of homeowners’ and renters’ insurance.

Investment apps

Example: Robinhood

Investment apps have democratized investing, making it accessible to a broader audience. Robinhood, known for commission-free trading, allows users to invest in stocks, cryptocurrencies, and exchange-traded funds (ETFs). These apps often provide real-time market data and educational resources to empower users to make informed investment decisions.

Banking apps

Example: Chime

Digital banking apps have transformed traditional banking services by offering a range of financial tools through user-friendly interfaces. Chime, for instance, provides features such as early direct deposit, no-fee overdraft, and automated savings. These apps prioritize convenience, often eliminating the need for physical branches and paperwork.

Regtech apps

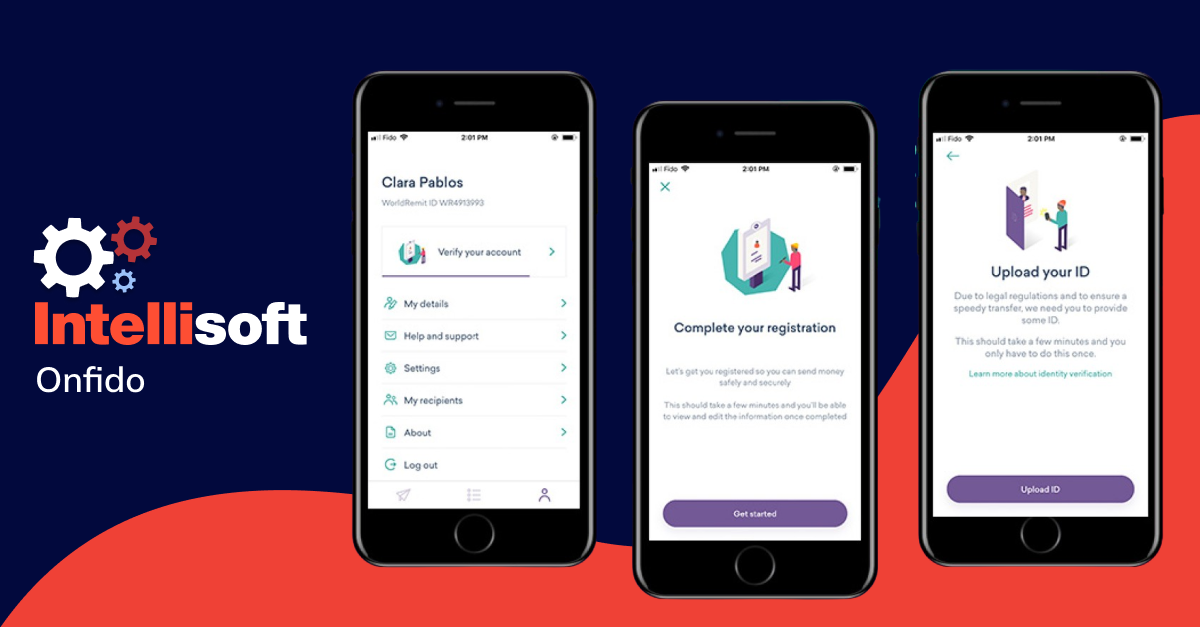

Example: Onfido

Regulatory technology (regtech) apps play a crucial role in helping financial institutions navigate complex compliance requirements. Onfido specializes in identity verification, utilizing AI and biometric technology to enhance security and meet regulatory standards. These apps contribute to the efficiency and accuracy of compliance processes.

Lending apps

Example: SoFi

Lending apps have revolutionized the borrowing landscape, offering an alternative to traditional banks. SoFi, for instance, provides student loan refinancing, personal loans, and mortgage options. These apps often leverage alternative data sources and advanced algorithms to assess creditworthiness swiftly, making the lending process more accessible.

Consumer finance

Example: Credit Karma

Consumer finance apps focus on empowering users to manage their credit scores and overall financial health. Credit Karma, now part of Intuit, offers free credit score monitoring, financial advice, and personalized recommendations. These apps aim to enhance financial literacy and decision-making.

Neobanks

Example: Revolut

Neobanks represent a digital evolution of traditional banking, operating without physical branches. Revolut, a prominent neobank, provides features such as multi-currency accounts, budgeting tools, and cryptocurrency trading. These apps prioritize agility, often introducing innovative features and disrupting traditional banking models.

As these FinTech app types continue to evolve, they collectively contribute to reshaping the financial landscape, offering users unprecedented control and accessibility in managing their financial affairs.

Related Readings:

- How to Build an iOS App for Your Start-up in 2023

- How to Create a Location-Based App: a Complete Guide

- How to Make a Social Media App: Detailed Guide

- How to Make Your Cross-Platform App That Thrives: A Step-by-Step Guide

- Web Development vs Mobile Development: What to Choose?

FinTech App Development Cost: App Type

You have probably wondered: “How much does it cost to build a FinTech app?” The cost of developing a FinTech app will differ significantly depending on the type of app you want to develop: a banking app, lending app, investment app, insurance app, or an app for consumer finance. Let’s break down the types of apps cost and the features included.

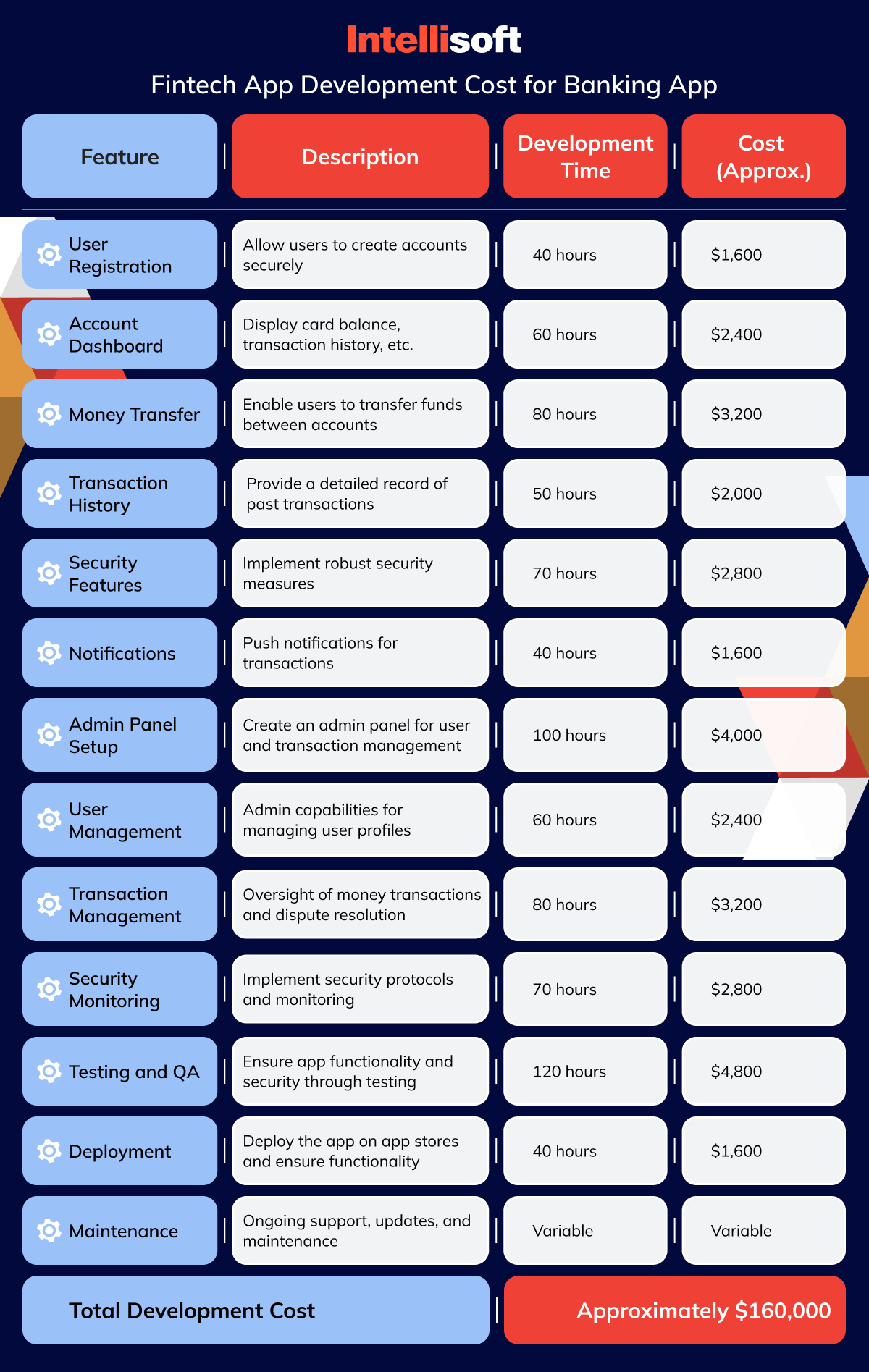

Banking App

If you want to develop a banking app, remember that the development cost will consist of the client-side and admin panel costs. The first part, the customer side, allows you to check the balance on the card, transaction history, transfer money to other accounts, and more. The admin panel is used for managing user profiles and money transactions.

Fintech App Development Cost for Banking App:

Total Development Cost: Approximately $160,000

Please note that the development time and FinTech application development price are approximate and can vary based on factors like the complexity of features, the technology stack, and the development team’s hourly rates. Additionally, ongoing maintenance costs are variable and may depend on the level of support and updates required.

Lending App

Lending apps, a prominent category within the FinTech ecosystem, play a crucial role in facilitating quick and accessible financial assistance. These applications streamline the lending process, offering users the convenience of borrowing funds at their fingertips. The development of lending apps involves creating a secure platform for loan requests, approval processes, and fund disbursement. The cost of developing a lending app can vary based on features such as user authentication, loan management, interest calculation, and integration with payment gateways.

Typically, the development of a lending app may range from $25,000 to $50,000 or more, depending on the complexity of features and the technology stack employed. It’s essential for developers to focus on robust security measures to ensure the protection of sensitive financial information and compliance with regulatory standards.

Fintech App Development Cost for Lending App:

Investment App

Investment apps have gained immense popularity as they provide users with easy access to various investment opportunities, allowing them to manage their portfolios on the go. These apps often offer features such as real-time market data, investment tracking, and personalized recommendations. Users can invest in stocks, bonds, cryptocurrencies, or other financial instruments through these platforms.

Cost of Developing a FinTech Product: an Investment App

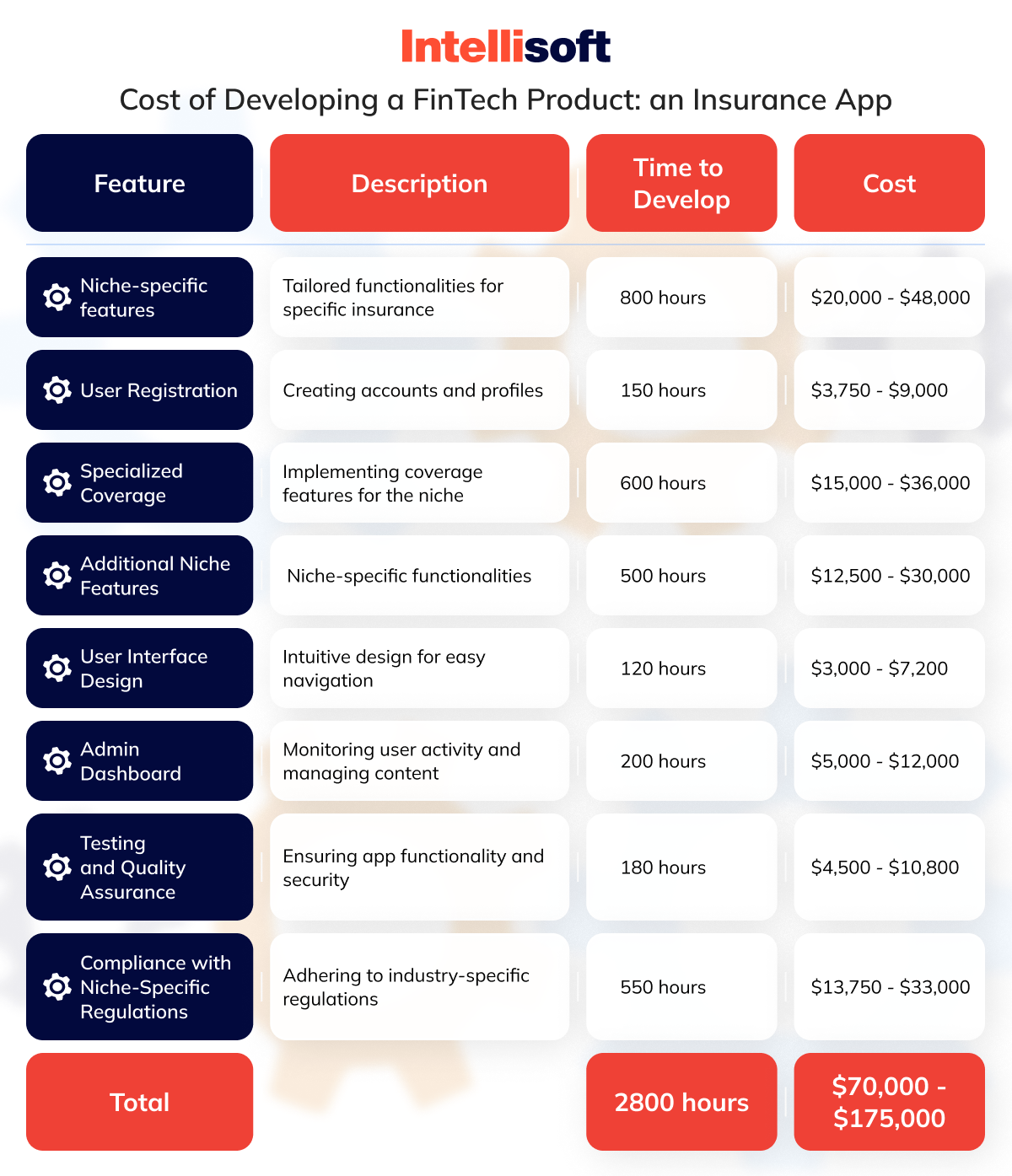

Insurance App

These apps offer a convenient platform for users to explore different insurance options, get quotes, and manage their policies seamlessly. With features such as instant claims processing and personalized policy recommendations, insurance apps enhance the overall customer experience.

There are different types of insurance apps:

- Health Insurance Apps

These apps focus on health-related coverage, allowing users to manage health insurance policies, access telehealth services, and track wellness activities. Additional features may include fitness tracking integration, personalized health tips, and virtual consultations. - Auto Insurance Apps

Designed for vehicle owners, auto insurance apps simplify policy management, facilitate claims processing, and provide real-time tracking of driving behavior. Some apps leverage telematics to monitor driving habits and offer discounts based on safe driving practices. - Pet Insurance Apps

Pet insurance apps cater to pet owners, offering coverage for veterinary expenses, vaccinations, and unexpected medical emergencies. Features may include a pet health tracker, reminders for vaccinations, and a network of affiliated veterinary clinics. - Travel Insurance Apps

Targeting travelers, these apps provide on-the-go access to travel insurance policies, emergency assistance services, and quick claims processing. Features may include real-time travel alerts, coverage for trip cancellations, and assistance during medical emergencies abroad.

Cost of Developing a FinTech Product: an Insurance App

These estimates are indicative and can vary based on the specific requirements of niche-specific insurance apps.

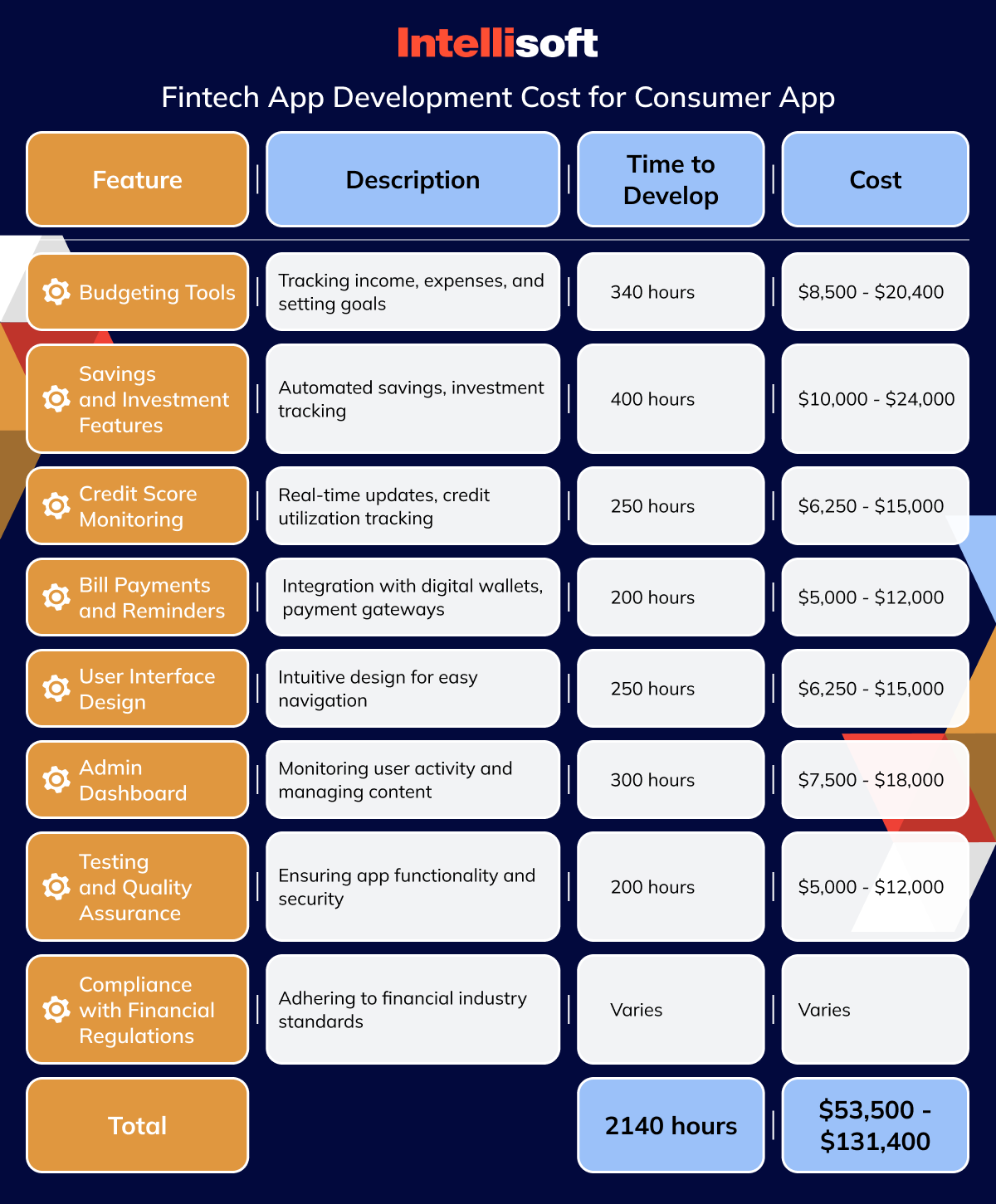

Consumer App

Consumer finance apps play a pivotal role in providing individuals with tools to manage their personal finances, budget effectively, and make informed financial decisions. These apps often integrate features for banking, budgeting, investing, and more. Here’s an overview of consumer finance apps and their development considerations:

- Budgeting and Expense Tracking

Consumer finance apps commonly feature robust budgeting tools, allowing users to track income and expenses and set financial goals. Integration with transaction categories, spending analysis, and financial planning features enhances the app’s utility. - Savings and Investment Integration

Many consumer finance apps facilitate savings and investment by offering features such as automated savings, investment portfolio tracking, and goal-based investing. Integrating third-party investment platforms and providing educational resources can enhance the user experience. - Credit Score Monitoring

Consumer finance apps may include tools for monitoring and improving credit scores, providing users with insights into their creditworthiness. Real-time credit score updates, credit utilization tracking, and personalized tips contribute to a comprehensive financial picture. - Bill Payments and Reminders

Ensuring timely bill payments is a crucial aspect of personal finance. Apps often integrate bill payment features and reminders to help users avoid late fees. Integration with digital wallets and payment gateways enhances convenience.

Factors Influencing the Cost of Developing a FinTech App

Calculating the total price of FinTech application development is a complex process that is influenced by multiple factors, including project management, time, the scope of work, location of the development team, UI/UX, and other factors.

There are three main constraints of project management that define the cost of your application. They are cost, scope, and time. It works like this – the faster you want to develop an app – the higher will be the cost, especially if you want to include multiple advanced features into your app.

Now, let’s dive into each factor that influences the cost of FinTech app development.

Product Requirements

The complexity and scope of your FinTech app’s features significantly impact the overall development cost. Clearly defined and detailed product requirements help in estimating costs more accurately.

The scope of work covers all the features and effort required to develop an app. The project’s size and the number of development hours expand in direct correlation with its scope. The intricacy of the software product’s concept influences the development, testing, and deployment efforts, with more sophisticated logic and concepts escalating the project’s difficulty.

UI/UX

The user interface (UI) and user experience (UX) design are paramount factors influencing the success of a FinTech app. A meticulously crafted, user-friendly interface not only demands more resources during the development phase, but also substantially contributes to better user adoption and overall satisfaction. A seamless and intuitive design fosters positive interactions, enhances user engagement, and, ultimately, positions the app for success in a competitive market.

Location of the Development Team

The geographical location of the development team plays a crucial role in determining development costs.

Offshore teams often offer cost-saving opportunities, with hourly rates varying based on the country. For instance, outsourcing to countries like India or Ukraine may provide a significant reduction in costs compared to hiring a development team in the United States or Western Europe. Hourly rates in countries like Ukraine can range from $50 to $120, while rates in the United States may range from $100 to $200 or more.

However, cost savings should be balanced with potential challenges. Effective communication and collaboration become pivotal elements when working with offshore teams. Differences in time zones can impact project timelines, and potential language barriers may affect the overall quality of deliverables. It’s essential to carefully evaluate these factors and choose a development location that aligns with the project’s requirements, considering both cost considerations and the need for efficient collaboration.

Time

The time required for development is a direct and consequential factor in determining overall costs. Extended development periods, especially when billed on an hourly basis, naturally lead to higher expenses. Striking a balance between time efficiency and project scope is crucial for effective cost management.

Maintenance

Post-launch maintenance constitutes an ongoing and often underestimated cost in the app development lifecycle. This phase involves regular updates, bug fixes, and continuous improvements to adapt to changing user needs and technological advancements. Proactive maintenance is essential for sustaining the app’s performance and relevance over time.

Advanced Technologies

The integration of advanced technologies, such as blockchain, artificial intelligence (AI), or machine learning, can introduce a layer of complexity and additional costs to the development process. These technologies often require specialized skills, adding to the overall budget. However, the strategic use of advanced tech can provide a competitive edge and innovative features.

Languages and Tools

The choice of programming languages and development tools significantly influences both development speed and costs. Some technologies may come with higher licensing fees, while others may require a higher level of expertise, impacting the overall budget allocation. Striking the right balance between efficiency and cost-effectiveness is crucial in technology selection.

Number of Features

The complexity and number of features incorporated into a FinTech app has a direct correlation with development time and resource requirements, consequently leading to increased costs. Careful consideration and prioritization of features based on essential functionalities are key to managing expenses effectively and ensuring a focused and streamlined user experience.

Number of 3rd-party Integrations

Integrating third-party services, such as payment gateways or analytics tools, introduces an additional layer of complexity to the development process. Each integration point brings potential challenges, requiring thorough testing and potential adjustments, which may demand extra development time and costs. Strategic planning and evaluation of necessary integrations are critical for a smooth and cost-effective development journey.

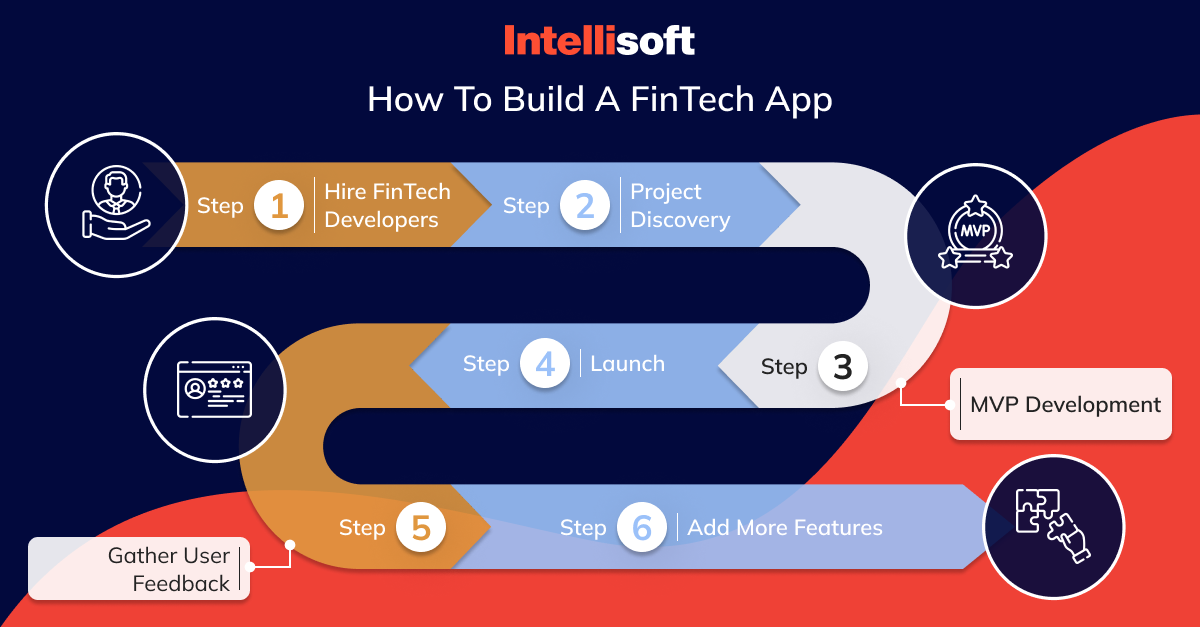

How to Build a FinTech App

When you know how a FinTech app is developed, you won’t be surprised when you hear the cost. Thus, you need to get acquainted with the development process and learn how to build a FinTech application before asking about the cost of developing such a product.

Step 1. Hire FinTech Developers

One of the main keys to successful FinTech app development is finding a reliable tech partner who will handle the development process. You can either hire separate developers or hire an entire team consisting of back-end and front-end developers, business analysts, project managers, designers, QAs, and product managers.

To hire FinTech developers, you need to choose a financial software development company first. When choosing a tech service provider, check their experience and expertise, hourly wages, and feedback. You can check their LinkedIn and Clutch profiles to read reviews by previous clients and learn more about their successful cases.

The developers you hire must be a perfect fit for your company, both professionally and culturally. Ensure that you are on the same page regarding project requirements and scope, that the team understands your needs and goals, and that they have established a clear line of communication with you.

Step 2. Project Discovery

The Project Discovery phase is a critical juncture where the development team collaborates with the client to define the project’s composition, estimate costs, establish timeframes, and outline deliverables. This collaborative effort lays the foundation for a comprehensive understanding of the project’s scope, setting the stage for subsequent development phases.

Step 3. MVP Development

Next, it’s time to launch a Minimum Viable Product (MVP) for your FinTech app. It will allow you to create the basic functional version of your product, test out the concept, gather user feedback, and understand what should be refined before market entry.

To navigate the MVP Development phase effectively, assembling the right team is essential. A FinTech development team typically comprises skilled professionals such as:

- Back-end

- Front-end developers

- Business analysts

- Project managers

- UI/UX designers

- Quality assurance specialists

- Product managers

This multifaceted team ensures a holistic approach to app development, addressing technical, functional, and user experience aspects.

All teams will have different hourly rates, which is one of the key factors determining expenses during the MVP phase. The hourly rates may differ based on the team’s location, expertise, and project scope.

When building an MVP, focus on creating a streamlined and user-friendly version that can be quickly launched into the market, allowing early user engagement and feedback.

Step 4. Launch

The Launch phase is when all the hard work behind the scenes pays off, and the app gets ready to hit the market. Your team will thoroughly test everything to make sure the app meets high-quality standards, fixing any issues they find.

The team will also make sure the app is easy for users to navigate and works well on different devices. While doing all of this, start gearing up for the big public release, planning how to tell people about the app, and getting it onto app stores. This phase is like the grand opening of the app, making sure it’s all set to shine and meet the financial needs of its users.

Step 5. Gather User Feedback

After the launch, it’s time for you and your team to tune in to what users have to say. Actively collecting feedback allows you to gain insights into their experiences, preferences, and any hiccups they might have encountered while using the app.

This continuous feedback loop serves as a roadmap for making the app better, ensuring it aligns with user needs and stays competitive in the ever-evolving market. It’s not just about fixing bugs; it’s about crafting an app that truly resonates with and serves your users.

Step 6. Add More Features

Now, as you and your team move into the phase of adding more features, it’s all about leveraging the insights gathered from user feedback. Here, features that were put on hold during the Project Discovery phase take center stage, prioritized according to user needs, market demands, and technological advancements.

This iterative process ensures that your app evolves, adapting to shifting user expectations and staying at the forefront of industry trends. By continually enhancing features, you’re not just keeping up; you’re future-proofing your app in the ever-changing landscape of FinTech.

Challenges in FinTech Application Development Process

After learning how to build a fintech app, you should also know about some issues. No development process comes without challenges, especially when it comes to creating a FinTech product with all its intricacies and advanced technologies. There are two main kinds of issues with launching a FinTech app: strategic and technical.

Strategic Challenges

- Preparing the pitch deck, securing financing, and navigating regulatory compliance are strategic hurdles that may arise.

- Organizational structural issues, rather than program-related problems, often fall under the category of strategic challenges.

- Compliance with national and international security protocols can pose strategic challenges during FinTech app development.

Technical Challenges

- Technical difficulties are directly linked to the conception, creation, and promotion of FinTech mobile apps.

- Challenges related to digital identities, data ownership, cloud migration, and integration of third-party components are common in the financial app development process.

FinTech App Development by IntelliSoft

IntelliSoft takes a comprehensive approach to guide startups through the initial stages of FinTech app development, ensuring a seamless journey from the discovery phase to Minimum Viable Product (MVP) development. Our Product Discovery lays the groundwork by identifying key project requirements, scope, and goals. This foundational step is vital for crafting a strategic roadmap for your app.

Next, during the MVP Development stage, we create a functional version of your FinTech app with core features. This approach allows for quicker market entry, user feedback, and iterative improvements, aligning with the agile principles of development.

For startups seeking a seasoned technical partner, our CTO as a Service provides invaluable expertise without the need for a full-time Chief Technology Officer. This service ensures sound technological decisions, effective team management, and strategic guidance throughout the development process.

Moreover, our Technology Scouting service assists startups in identifying and adopting cutting-edge technologies that can enhance their FinTech solutions. This proactive approach ensures that your app remains at the forefront of technological innovation.

Contact us and embark on an exciting journey of FinTech app development with confidence, backed by a team of experts dedicated to ensuring your success.