With projected fraud losses expected to surpass $40 billion by 2027, financial institutions are under growing pressure to enhance their prevention measures and protect customer assets.

The nature of fraud in the banking sector has transformed significantly, driven by rapid technological advancements and the expanding use of digital platforms for financial transactions. While these innovations improve efficiency, they also create new opportunities for fraudsters to exploit weaknesses in digital systems.

In response, fraud detection tools in banking have become essential, helping banks combat increasingly sophisticated tactics. Using advanced technologies, these systems offer real-time fraud prevention by quickly identifying suspicious behavior and anomalies. This proactive approach helps banks minimize risks and safeguard their operations and customer trust. What is fraud detection in banking? Learn more about it in this detailed guide by IntelliSoft.

Table of Contents

Why Banks Need Fraud Detection Tools

Banks manage enormous volumes of sensitive financial data and process countless daily transactions. This makes them an attractive target for fraudsters, underscoring the need for robust detection tools. Here’s why these tools are essential:

- Safeguard customer assets. Fraud detection systems enable banks to protect their customers’ savings, investments, and personal details from theft and unauthorized access.

- Ensure regulatory compliance. Financial institutions are required to meet strict regulations, such as Anti-Money Laundering (AML) and Know-Your-Customer (KYC) standards. Fraud detection tools assist banks in adhering to these legal obligations.

- Maintain trust and reputation. Financial fraud incidents can seriously harm a bank’s reputation. Effective prevention measures help maintain customer confidence in the institution.

- Reduce financial loss. Fraud can result in substantial financial damage for both banks and their customers. Early detection plays a key role in mitigating these losses.

- Counter evolving fraud tactics. Fraudsters continuously adapt, using techniques such as phishing, identity theft, and synthetic identities. Advanced AI and machine learning tools allow banks to stay ahead of these changing tactics.

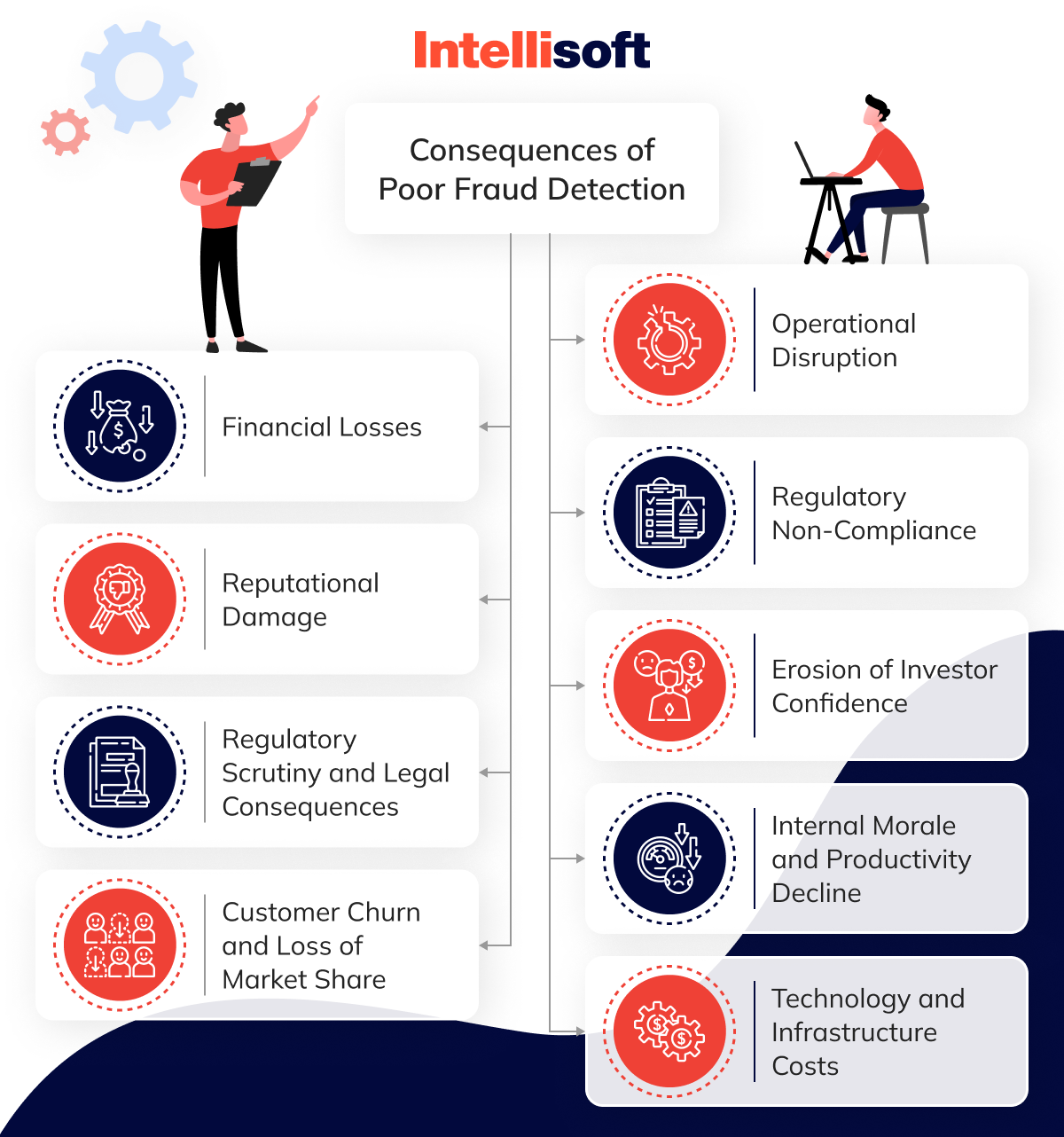

What Can Poor Fraud Detection Result for Banks?

When banks fail to implement robust fraud detection mechanisms, the fallout can be substantial, touching multiple facets of their operations, reputation, and overall business. The consequences extend beyond financial loss, potentially disrupting customer trust, internal processes, and long-term stability.

Financial Losses

Fraud can lead to significant financial repercussions for banks, starting with direct losses from unauthorized transactions, fraudulent loans, or stolen funds. In addition to these losses, banks may also need to reimburse affected customers, compounding the financial strain. Furthermore, regulatory authorities can impose substantial fines, especially when fraud involves violations of Anti-Money Laundering (AML) regulations or other financial compliance laws.

Reputational Damage

When a bank fails to detect fraud, it erodes customer trust and invites negative media attention, damaging the institution’s reputation. The loss of clients and the years of PR efforts needed to restore credibility can have a lasting impact on the bank’s image.

Regulatory Scrutiny and Legal Consequences

A failure in fraud detection can expose banks to significant risks, including heightened regulatory scrutiny and legal action. In extreme cases, regulatory agencies may impose stricter audits, additional reporting requirements, or even revoke licenses. At the same time, banks could face costly lawsuits from customers and shareholders, particularly if negligence is evident, leading to prolonged legal battles.

Customer Churn and Loss of Market Share

Fraud or data breaches drive existing customers away to more secure financial institutions and harm the bank’s reputation, discouraging potential customers from opening new accounts. This can result in a loss of market share and new customer acquisition in highly competitive markets.

Operational Disruption

When fraud goes undetected for an extended period, banks must allocate significant time and resources to investigating and resolving the issue. This disruption can also necessitate costly system overhauls to improve prevention mechanics, further complicating daily operations.

Regulatory Non-Compliance

Inadequate detection can lead to breaches of financial regulations, such as AML, KYC, or PSD2. This lack of compliance may result in hefty fines, regulatory penalties, or even the suspension of certain banking services.

Erosion of Investor Confidence

Major fraud detection failures can severely undermine investor confidence, leading to a decline in the bank’s stock price and market value. In response, shareholders may push for leadership changes or demand stricter oversight, which could cause further disruption at the executive level.

Internal Morale and Productivity Decline

When poor fraud detection results in adverse effects, such as layoffs or company restructuring, employees may lose trust in the organization. This can lead to a more stressful atmosphere in the workplace, which in turn dampens morale and reduces overall productivity.

Technology and Infrastructure Costs

Banks may face significant financial burdens after a major fraud event, requiring substantial investments in upgrading fraud detection systems, incorporating AI/ML-based technologies, and enhancing cybersecurity defenses. When fraud results from security breaches, these costs can escalate further as institutions must bolster their data protection infrastructure.

Recent Cases of Poor Fraud Detection in Banking and Consequences

In recent years, several high-profile scandals have illuminated significant gaps in fraud detection within the banking industry. From forged accounts to missing billions, these cases demonstrate how critical it is for financial institutions to tighten their security measures. Below, we explore some of the most notable failures in recent memory and the severe consequences they triggered.

Wirecard Scandal (2020)

In 2020, Wirecard, a German payment processor collapsed when €1.9 billion was found missing from its accounts. The company had been engaging in fraudulent activities for years, which went undetected by its auditors. Wirecard declared bankruptcy, and its top executives were arrested. The scandal also damaged trust in Germany’s financial regulator, BaFin, which was criticized for missing the warning signs.

Wells Fargo Fake Accounts Scandal (2016)

Wells Fargo employees secretly created millions of fake accounts to meet sales goals without customers’ consent. The bank’s internal controls failed to catch these fraudulent actions. Wells Fargo was fined $3 billion and suffered significant reputational damage. The CEO resigned, and the bank has since struggled to rebuild customer trust.

PNC Bank Fraud Case (2021)

In 2021, fraudsters exploited vulnerabilities in PNC Bank’s identity verification system to open accounts using stolen identities. The bank faced significant financial losses, and customers had to deal with the inconvenience of compromised accounts. This case exposed the need for better fraud prevention and identity verification measures.

Capital One Data Breach (2019)

A hacker exploited a security flaw in Capital One’s system, gaining access to over 100 million customer accounts and credit card applications. Capital One was fined $80 million, faced lawsuits, and suffered reputational damage. The breach underscored the importance of robust security and detection systems in the banking sector.

Related articles:

- Legal requirements for storing data: key insights for storing user data

- What Threatens Your Web Application Security

- From Concept to Creation: How to Master the Discovery Phase of Product Development

- Behind the Buffering: Understanding the Tech Stack for Video Streaming

- Detailed Guide On How to Develop a MarTech Platform

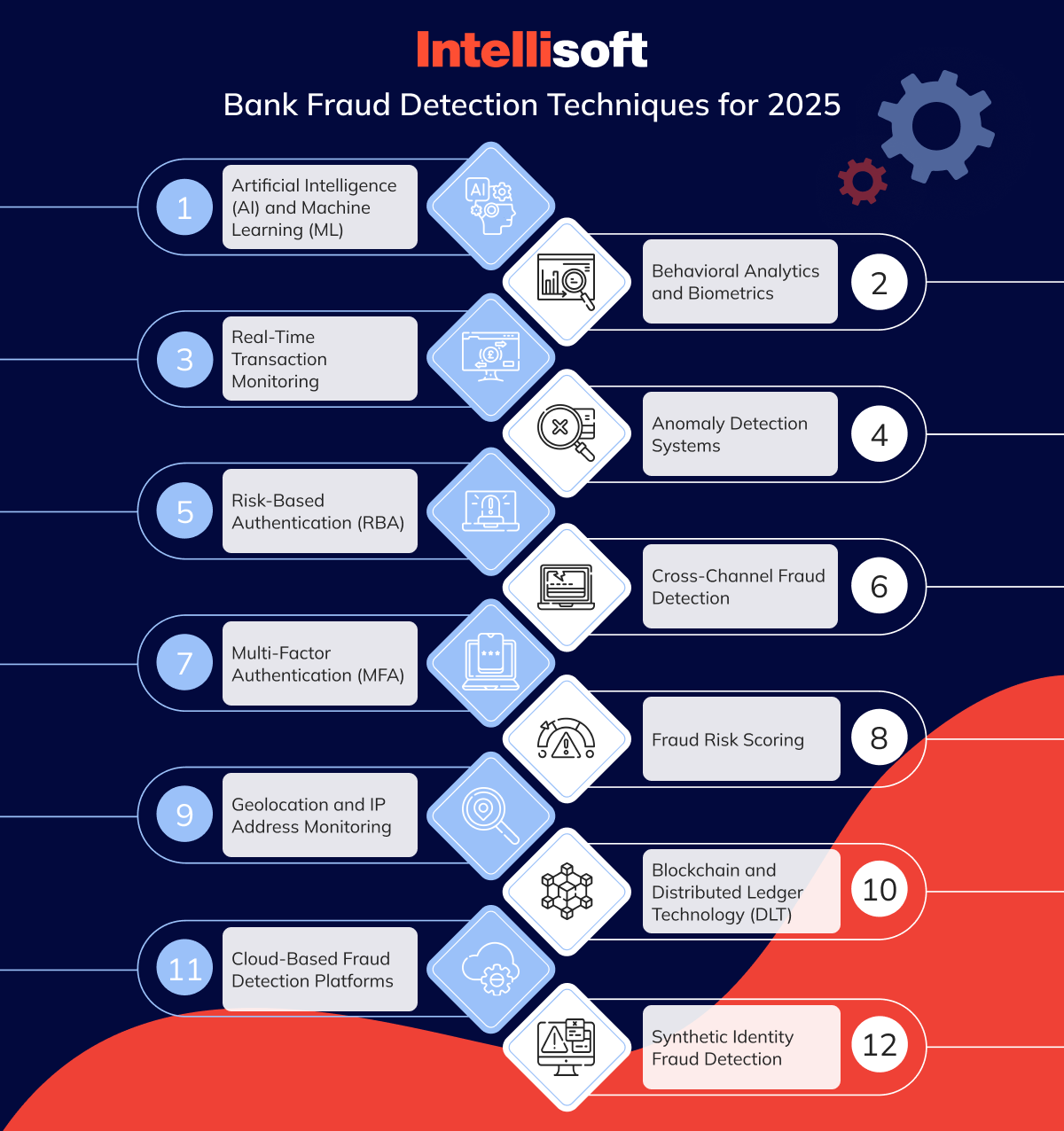

Bank Fraud Detection Techniques for 2025

As we move into 2025, banks must keep pace with increasingly sophisticated threats by evolving their fraud detection strategies. The most effective methods to detect and prevent fraud that should be prioritized include:

Artificial Intelligence (AI) and Machine Learning (ML)

AI in bank fraud detection and machine learning algorithms process vast amounts of data to pinpoint unusual behavior patterns that may signal fraudulent activity. These models are continuously refined by learning from historical data, enabling them to detect known and emerging fraud forms.

Why it’s useful:

- Capable of identifying sophisticated, evolving fraud schemes that traditional rule-based systems may overlook.

- Continuously improves by incorporating new data, making it more accurate over time.

- Operates in real time, allowing for immediate identification and prevention of suspicious transactions.

AI and machine learning in bank fraud detection are especially effective in detecting credit card fraud, identity theft, fraudulent loan applications, and financial transaction monitoring.

Behavioral Analytics and Biometrics

Behavioral analytics track customer behavior patterns, such as typing speed, interactions with their device, and location data. Meanwhile, biometric methods—including fingerprint scans, facial recognition, and voice identification—verify user identities.

Why it’s useful:

- Identifies suspicious behavior by flagging unusual or inconsistent actions.

- Enhances security through the use of unique biological markers.

- Combines with traditional security measures such as passwords and PINs for robust multi-factor authentication (MFA).

This technology is especially valuable for preventing account takeovers, securing online banking, and protecting mobile payment systems.

Real-Time Transaction Monitoring

Real-time transaction monitoring continuously analyzes transactions as they occur, identifying unusual activity and flagging high-risk behaviors.

Why it’s useful:

- Provides instant detection of fraudulent transactions, helping to minimize potential losses.

- Can be paired with AI and machine learning to enhance detection accuracy.

- Allows immediate action, such as blocking suspicious transactions or flagging accounts before fraud is finalized.

This approach is especially useful in combating credit and debit card fraud, wire fraud, and instant payment security.

Anomaly Detection Systems

These systems leverage statistical models and machine learning to create a baseline of normal user behavior, flagging activities that significantly deviate from this norm.

Why it’s useful:

- Detects fraudulent activity without relying on a fixed set of rules.

- Highly effective at spotting unusual spending patterns or risky account behavior.

- Provides an early warning system for new and evolving fraud threats.

Common use cases include flagging unusual withdrawal amounts, transactions in high-risk locations, or sudden shifts in spending habits.

Risk-Based Authentication (RBA)

Risk-based authentication (RBA) assesses multiple factors in real time—such as the device used, IP address, and geolocation—to determine the risk level of each transaction. Depending on the calculated risk score, additional authentication steps may be triggered.

Why it’s useful:

- Offers a dynamic, risk-adjusted approach to user authentication.

- Minimizes customer inconvenience by only requesting extra verification when the risk is deemed high.

- Aids in preventing account takeovers and phishing attempts.

This method is useful for securing online banking logins, mobile payments, and high-value transactions.

Cross-Channel Fraud Detection

Cross-channel fraud detection consolidates data from different banking channels—like ATMs, online banking, and mobile apps—to provide a comprehensive view of customer activity and spot fraud across various touchpoints.

Why it’s useful:

- Detects fraud patterns spanning multiple channels, such as coordinated attacks involving ATMs and online banking.

- Improves fraud detection by identifying suspicious behavior that might be missed in isolated systems.

- Ensures consistent fraud prevention across both digital and physical banking environments.

Ideal for combating multi-channel fraud, phishing schemes, and fraud across multiple devices.

Multi-Factor Authentication (MFA)

Multi-factor authentication (MFA) requires customers to provide two or more verification methods—such as a password, fingerprint, or SMS code—before completing a transaction or accessing an account.

Why it’s useful:

- Adds an extra layer of security beyond just passwords or PINs.

- Helps prevent account takeovers by protecting against stolen or compromised credentials.

- Customizable, enabling banks to apply different security levels based on the risk of the transaction.

Commonly used for online banking, mobile banking, and securing high-value transactions.

Fraud Risk Scoring

Fraud risk scoring systems evaluate transactions by assigning risk scores based on transaction size, customer behavior, and location. Transactions deemed high-risk are flagged for further review or may require additional verification.

Why it’s useful:

- Helps prioritize the review of transactions that present a higher risk.

- Reduces false positives by flagging only genuinely suspicious activity.

- Streamlines prevention with automated decision-making.

Commonly used for high-value transfers, card-not-present (CNP) fraud, and securing mobile payments.

Geolocation and IP Address Monitoring

Geolocation and IP monitoring track a user’s device’s geographic location during transactions. Additional verification steps are triggered if a login attempt originates from an unusual or suspicious area.

Why it’s useful:

- Detects suspicious access attempts from unexpected or high-risk regions.

- Prevents fraudsters from using VPNs or proxies to bypass security.

- Enhances real-time fraud detection for online and mobile banking platforms.

This approach effectively prevents cross-border fraud, remote account takeovers, and phishing attacks.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain technology can create a secure and transparent ledger for tracking transactions. Its immutable nature ensures real-time identification of tampered or fraudulent records.

Why it’s useful:

- Increases security and transparency in financial transactions.

- Reduces the risk of fraud in cross-border transactions and digital currencies.

- Enables decentralized transaction validation, avoiding single points of failure.

Ideal for cross-border payments, digital currencies, and preventing fraud in cryptocurrency.

Cloud-Based Fraud Detection Platforms

Cloud-based fraud detection systems offer scalability, flexibility, and advanced real-time analytics powered by AI and big data.

Why it’s useful:

- Delivers real-time fraud detection with quicker deployment and reduced costs.

- Provides continuous updates and access to the latest detection algorithms.

- Scales easily support global operations.

Ideal for global banking, cross-border transactions, and online banking.

Synthetic Identity Fraud Detection

Synthetic identity fraud detection tools analyze data patterns to identify fake or partially fabricated identities used to open accounts or apply for credit.

Why it’s useful:

- Tackles one of the fastest-growing types of fraud in the banking industry.

- Prevents fraudsters from using real Social Security numbers or other credentials to create fake identities.

- Leverages advanced AI models to distinguish between genuine customers and synthetic identities.

Commonly used for new account openings, loan applications, and credit card applications.

Strategies for Effective Fraud Detection in Banks

Adopting comprehensive strategies that strengthen security while ensuring regulatory compliance is the key to avoiding potential fraud. Let’s explore some of the most effective ways banks can safeguard their operations and stay one step ahead of fraudsters.

Integrate Multi-Layered Security Measures

Banks should adopt multi-layered security strategies to safeguard against different types of fraud. These measures enhance the defense system by covering multiple points of vulnerability, such as the network, application, and user levels. Secure network infrastructure, robust encryption for sensitive information, and multi-factor authentication all play a critical role in this approach.

By creating several layers of security, banks can make it significantly harder for fraudsters to gain unauthorized access or conduct illicit transactions.

Ensure Compliance and Regulatory Adherence

Banks operate under strict regulatory frameworks designed to protect customer data and enforce security. As such, detection systems must comply with these industry regulations and legal standards. This includes implementing security measures, data protection protocols, and reporting mechanisms in line with regulatory requirements.

By adhering to these regulations, banks strengthen their defenses against fraud, avoid potential legal repercussions, and preserve their reputation within the industry.

Regularly Update and Test Fraud Detection Protocols

Continuous improvement of fraud detection systems is essential for staying ahead of evolving threats. Banks should routinely review and upgrade their prevention tools by integrating the latest technologies, algorithms, and data analysis methods to enhance their precision and effectiveness.

Equally important is regular testing of these systems. Banks should simulate real-world fraud attempts using historical data to assess how well their systems can detect and prevent fraudulent activities.

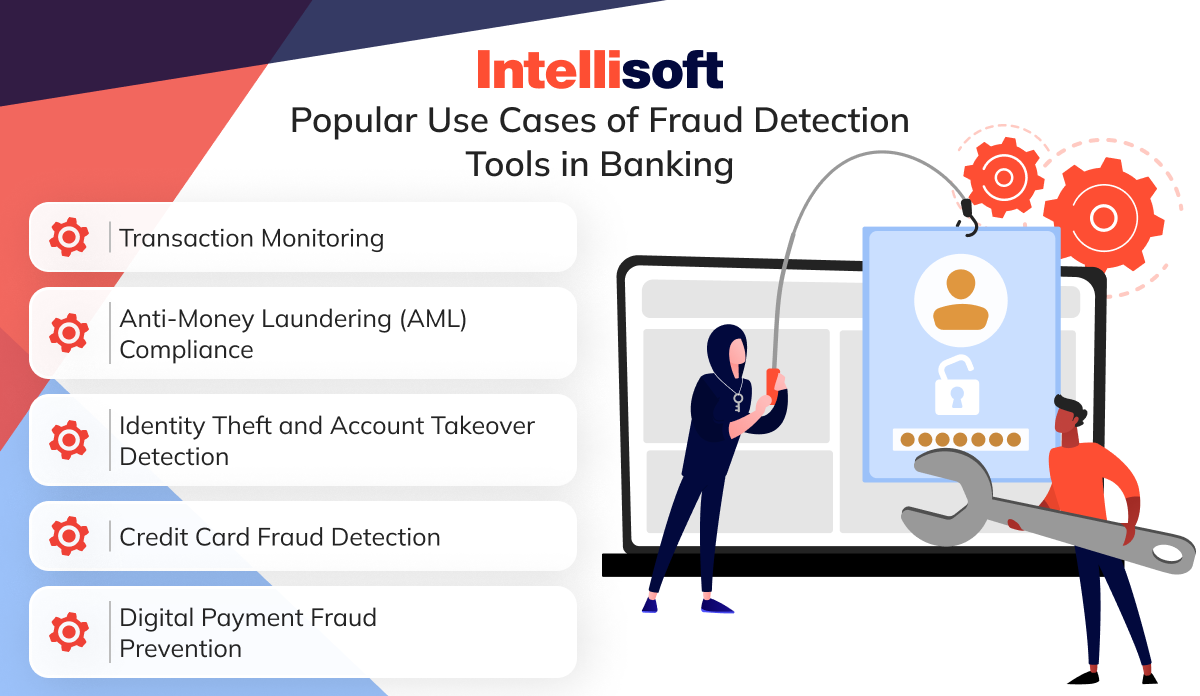

Popular Use Cases of Fraud Detection Tools in Banking

Fraud detection tools in banking are applied in several key areas to detect, prevent, and minimize fraudulent activities. Some of the most common use cases include:

Transaction Monitoring

Monitoring real-time transactions plays a crucial role in spotting anomalies, such as unusual spending habits, transactions from suspicious locations, or behavior that doesn’t align with a user’s typical purchase history. By leveraging machine learning algorithms alongside rule-based systems, companies can flag these irregularities, offering an effective way to prevent unauthorized activities. This approach includes issues like credit card fraud, wire fraud, or even account takeovers, where a user’s financial information is compromised.

Anti-Money Laundering (AML) Compliance

Detecting and preventing money laundering involves identifying unusual account behavior, such as large transfers or deposits that seem inconsistent with a customer’s financial profile. To tackle this, Anti-Money Laundering (AML) tools harness the power of artificial intelligence and machine learning to flag potentially suspicious activities. These tools are especially effective in recognizing complex laundering schemes, such as smurfing—where transactions are structured to evade detection—and other techniques such as placement, layering, and integration.

Identity Theft and Account Takeover Detection

Detecting identity theft involves spotting when fraudsters use stolen or fabricated identities to open new accounts, take control of existing ones, or apply for loans. Organizations use tools such as multi-factor authentication (MFA), biometric verification, behavioral analytics, and device fingerprinting to combat this. These technologies work together to identify suspicious login attempts or unusual activity during new account openings, helping to prevent unauthorized access and identity misuse.

Credit Card Fraud Detection

Detecting fraudulent credit card transactions involves identifying when stolen or counterfeit cards are used, or when transactions occur without the cardholder’s knowledge. Banks combat this by employing real-time detection systems that continuously monitor transaction patterns, such as the speed of purchases, the geographic location of the transactions, and the types of merchants involved. By analyzing these factors, banks can quickly flag potentially fraudulent activities and take action to protect their customers. Therefore, you should learn how to set threshold for credit card fraud detection.

Digital Payment Fraud Prevention

Monitoring online and mobile banking activities is crucial for preventing unauthorized digital transactions, such as those resulting from phishing attacks or compromised login credentials. Banks use real-time monitoring systems to analyze user behavior, including login habits, geolocation, device recognition, and biometric data like fingerprints or facial recognition. By identifying unusual patterns, these systems help detect and stop potential threats before they cause harm.

Custom Fraud Detection Tools for Banking vs SaaS

Choosing whether to create a custom fraud detection tool or a SaaS-based solution in banking hinges on several important factors. These include the specific requirements of the bank, its budget constraints, the level of internal expertise available, and the bank’s long-term goals. Both approaches have their merits, but understanding when each one is most appropriate can help guide the decision:

When to Go SaaS for Fraud Detection

SaaS-based fraud detection solutions are ideal in several scenarios:

- Quick deployment. When you need a fast solution without building from scratch, SaaS offers rapid implementation. A mid-sized bank launching new services can quickly meet fraud detection needs with a SaaS tool.

- Cost efficiency. SaaS is budget-friendly, offering subscription models that avoid high upfront development costs. Smaller banks and fintech startups benefit from the lower initial investment and predictable costs.

- Advanced features. SaaS platforms have built-in AI, ML models, and real-time monitoring, providing sophisticated detection without in-house development. Banks can leverage platforms like Feedzai or FICO Falcon for cutting-edge fraud algorithms.

- Scalability. SaaS scales effortlessly with growth, supporting increased transactions or market expansion. Rapidly growing fintechs and neobanks use SaaS to handle rising transaction volumes smoothly.

- Maintenance. SaaS providers handle updates and maintenance, ensuring systems stay current with the latest security and compliance standards. A regional bank with limited IT staff can rely on SaaS for continuous updates and improvements.

- Regulatory compliance. SaaS tools are built with compliance in mind, covering regulations like AML, KYC, and PSD2. Banks operating across multiple countries can ensure compliance with local laws via SaaS solutions.

- Access to global data. SaaS providers offer insights from global fraud data, helping detect patterns early through industry benchmarks. Solutions like NICE Actimize or LexisNexis ThreatMetrix provide banks with the latest fraud trends.

- Integration. SaaS platforms integrate easily with other cloud-based services like CRMs and payment gateways. Banks using tools like Salesforce or Stripe can benefit from seamless fraud detection integration.

When to Develop a Custom Fraud Detection Tool

Developing a custom fraud detection system offers flexibility and control but demands significant resources, time, and expertise. Here are situations where a custom solution might be the best fit:

- Specific or complex needs. Off-the-shelf solutions may lack the customization if your bank operates in specialized areas like cross-border payments, cryptocurrency, or decentralized finance. Banks handling complex, high-value transactions often need tailored fraud detection models to manage unique risks.

- Full data control. If your bank requires complete control over data and algorithms—perhaps due to regulatory demands like GDPR or CCPA—custom-built solutions ensure compliance and secure data management in sensitive sectors.

- Strategic investment. If fraud detection is a key differentiator, investing in a custom system allows for long-term innovation, adapting as fraud trends evolve. Multinational banks with complex operations often prefer this approach for seamless integration across products and services.

- In-house expertise. Developing and maintaining a custom detection system becomes more feasible if your bank has a strong internal team of data scientists and engineers. Tech-savvy institutions or large investment banks might use this to retain flexibility and control.

- Legacy system integration. Banks with older legacy systems may find integrating SaaS solutions challenging due to proprietary workflows or data formats. Building a custom system that aligns with existing infrastructure can be more efficient.

- Extensive customization. A custom solution is often required for banks needing highly specific fraud rules—such as integrating local fraud databases or detecting region-specific patterns—especially when SaaS platforms may not offer enough flexibility.

5 Popular Software for Fraud Detection in Banking

Let’s dive into the top 5 financial fraud detection software solutions. This carefully selected list highlights each platform’s core features and outlines its appropriateness for different business needs. We aim to give you the insights necessary to make an informed decision and select the most advanced fraud detection software for banks.

1. SAS Fraud Management

SAS is a top-tier provider of sophisticated analytics and fraud detection solutions tailored for the financial sector. Their SAS Fraud Management platform equips banks to identify, prevent, and address financial crimes, including card fraud, wire fraud, and breaches of AML (Anti-Money Laundering) regulations.

Key Features:

- Real-time monitoring of transactions with advanced anomaly detection.

- Adaptive detection powered by machine learning models.

- Multi-channel detection covering ATMs, online platforms, mobile banking, and more.

- Integrated case management and workflow tools for handling fraud investigations.

- Detailed analytics and reporting capabilities to meet compliance requirements.

SAS offers custom pricing based on each enterprise’s specific needs. Their solutions typically fall into the higher pricing bracket, with annual licensing costs starting from $100,000, depending on the scope and features required.

2. FICO Falcon Fraud Manager

FICO Falcon is a leading fraud detection system used extensively in the banking industry. It utilizes artificial intelligence and machine learning to safeguard over 2.6 billion cards globally. Its primary focus is on detecting and preventing transaction fraud.

Key features:

- Neural network-based models for detecting and preventing fraud.

- Real-time scoring of transactions to combat card fraud.

- Multi-channel detection, covering cards, loans, and digital banking.

- Advanced analytics with customizable fraud detection models.

- Automated tools for case management and investigations.

FICO Falcon offers custom pricing based on implementation size. Large-scale deployments for major banks typically start at $500,000 per year. Smaller banks and financial institutions may experience lower costs, but they are still within the six-figure range.

3. Feedzai

Feedzai is an AI-powered platform designed to help financial institutions detect and prevent online fraud and money laundering. Its real-time, risk-based approach offers comprehensive protection across multiple channels.

Key аeatures:

- Machine learning-driven fraud detection for real-time transaction monitoring.

- Behavior-based anomaly detection.

- Omnichannel protection, covering card transactions, online banking, and mobile payments.

- Easy integration via API.

- Continuous updates and improvements through AI.

Feedzai offers custom pricing based on transaction volume. Smaller implementations typically start at $100,000 annually, while larger enterprises with high transaction volumes may see significantly higher costs.

4. NICE Actimize

NICE Actimize delivers a comprehensive fraud detection and anti-money laundering (AML) solution for banks, offering protection across multiple channels such as credit cards, ATMs, mobile, and online banking.

Key features:

- AI and machine learning algorithms for detecting fraud.

- Real-time monitoring and cross-channel protection.

- Automated generation of suspicious activity reports (SARs) to meet AML compliance.

- Integrated case management tools for fraud investigations.

- Pre-configured and customizable workflows to ensure regulatory compliance.

NICE Actimize pricing is custom, with costs starting at around $250,000 annually for smaller institutions, scaling higher for larger enterprises depending on the scope of the implementation.

5. ThreatMetrix by LexisNexis Risk Solutions

ThreatMetrix is a digital identity platform that helps banks detect and stop fraud by analyzing identity, device, and behavioral data. It utilizes a global intelligence network to enhance fraud prevention efforts.

Key features:

- Digital identity intelligence and risk assessment.

- Behavioral biometrics for advanced fraud prevention.

- Device fingerprinting and geolocation tracking.

- Real-time detection powered by global transaction data.

- API integration for seamless compatibility with existing banking systems.

ThreatMetrix offers custom pricing, with rates typically starting around $50,000 annually for smaller banks. Pricing scales based on transaction volume and the features required.

How Much Does It Cost to Develop a Custom Fraud Detection Software for Banking?

The cost of building a custom fraud detection system for the banking sector can fluctuate quite a bit, depending on various elements. These factors include the platform’s complexity, the development team’s size and expertise, the technology stack employed, and the specific features or functionalities the system needs. Below is a summary of the key cost factors, along with typical price ranges for developing such a solution:

Scope and Features

The more sophisticated the system, the higher the cost. Key features include:

- Real-time transaction monitoring

- AI and machine learning for detecting fraud

- Algorithms for anomaly detection

- Fraud detection across multiple channels (ATM, mobile, online)

- Behavioral analytics and biometric authentication

- Integration with external fraud detection APIs and KYC tools

- Risk scoring models

- Case management for investigations

- Compliance with regulations like AML and PSD2

Fraud detection system costs depend on complexity. Basic systems with rule-based detection and simple monitoring range from $500,000 to $1 million. More advanced systems, using machine learning and AI for multi-channel detection, cost between $1 million and $3 million. The most sophisticated setups, featuring real-time detection, behavioral analytics, and regulatory compliance, can exceed $3 million to $10 million.

Development Team

Developing a custom fraud detection software project requires a highly experienced team, typically composed of:

- Project manager. Manages the overall development and team coordination.

- Data scientists. Create AI and machine learning models for fraud detection, anomaly detection, and predictive analytics.

- Software engineers. Develop the core system, ensuring it is scalable and reliable.

- UI/UX designers. Design intuitive interfaces for fraud analysts and compliance teams.

- DevOps engineers. Handle deployment, continuous integration (CI), and continuous delivery (CD) processes.

- QA engineers. Test the system for performance, accuracy, and security.

- Regulatory experts. Ensure compliance with financial regulations such as AML, KYC, and GDPR.

A skilled team of 8-12 members, including developers, data scientists, and QA engineers, can cost between $100,000 and $200,000 per month. For a project lasting 12 to 18 months, the total development cost would range from $1.2 million to $3.6 million.

Technology Stack

The choice of technology significantly influences both development and long-term expenses:

AI/ML libraries

Options include TensorFlow, PyTorch, Scikit-learn, or custom-built machine learning models.

Big data infrastructure

Frameworks such as Apache Kafka or Apache Flink support real-time data processing.

Cloud services

Platforms such as AWS, Google Cloud, or Microsoft Azure offer hosting solutions, though costs can increase depending on the scale and storage requirements.

Database solutions

SQL options (PostgreSQL, MySQL) and NoSQL databases (MongoDB, Cassandra) are viable choices.

Security

Key measures include end-to-end encryption, tokenization, and multi-factor authentication (MFA).

DevOps and automation

Continuous integration and deployment (CI/CD) tools streamline updates and scaling efforts.

Initial setup costs, which include licenses, hosting, and infrastructure, typically range from $100,000 to $500,000. Monthly operational expenses can vary, generally falling between $10,000 and $50,000 depending on the data volume and usage of cloud services.

Regulatory Compliance

Banks must adhere to stringent regulatory standards aimed at preventing fraud. These include:

- Anti-money laundering (AML)

- Know your customer (KYC)

- Payment services directive 2 (PSD2)

- General data protection regulation (GDPR)

Ensuring adherence to these legal and security requirements can increase development costs by anywhere from $100,000 to $500,000. Additionally, yearly expenses for compliance audits and necessary updates typically fall between $50,000 and $200,000.

Integration with Legacy Systems

When a bank operates on legacy systems, incorporating a new fraud detection tool can extend both development timelines and associated costs. Integrating with core banking infrastructure, payment gateways, and third-party APIs for KYC/AML processes often demands additional resources.

Cost estimates for such integrations typically range from $200,000 to $1 million, depending on the complexity of the existing systems and the number of required integrations.

Data and AI Model Training

Creating fraud detection software involves training machine learning models, which requires a large volume of transaction data. If the bank lacks enough of its own data, it may need to rely on external sources or generate synthetic data to fill the gap.

Developing fraud detection software requires extensive transaction data, and if a bank lacks sufficient data, it may need third-party sources or synthetic data. Data acquisition and processing costs can range from $50,000 to $500,000, while AI model development and training could run from $200,000 to over $1 million, depending on complexity and data availability.

Maintenance and Ongoing Development

Once the software is up and running, regular maintenance, updates, and enhancements become crucial. Fraud detection models, in particular, need constant tweaking to remain effective against evolving threats.

Estimated ongoing expenses range from $200,000 to $1 million per year. These costs cover essential tasks like maintenance, data model retraining, feature development, and infrastructure scaling to meet growing needs.

Time to Develop

Developing custom fraud detection software typically takes 12 to 18 months, depending on the complexity, required integrations, and specific features.

Overall Cost Estimate

Taking all these factors into account, the overall cost to develop a tailored fraud detection system can vary significantly:

- The expense typically falls between $1.5 million and $3 million for a small to mid-sized bank.

- Costs can range from $5 million to $10 million or more for a larger bank or a more intricate implementation.

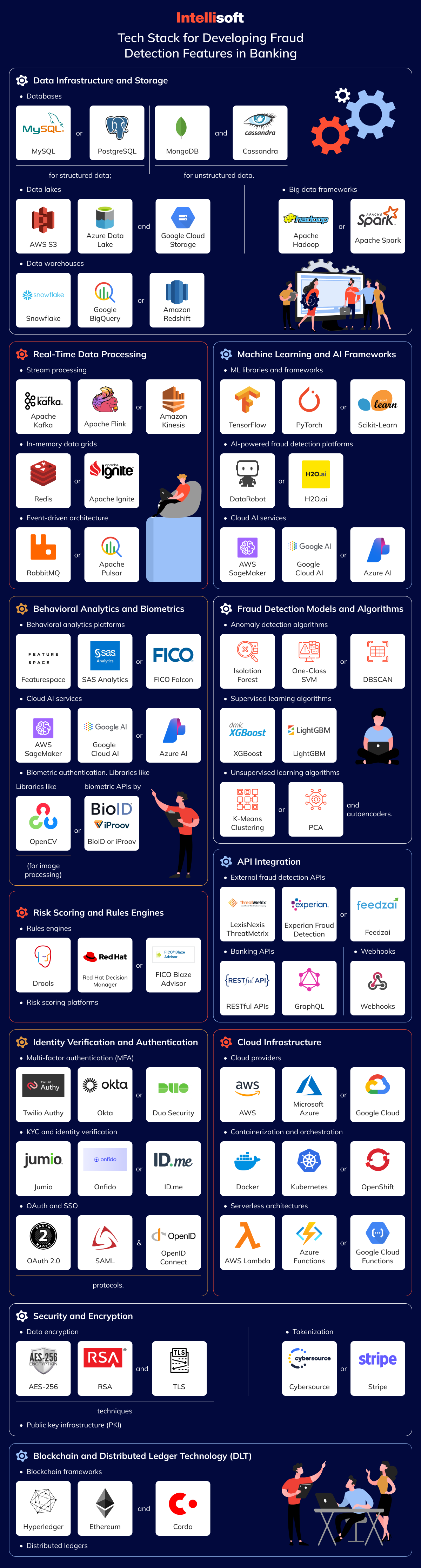

Tech Stack for Developing Fraud Detection Features in Banking

Developing fraud detection features in the banking sector necessitates a robust and highly capable tech stack, designed to process data in real time, integrate machine learning, perform behavioral analytics, and ensure secure transactions. Below are the essential components typically involved in constructing such a fraud detection system:

Data Infrastructure and Storage

The system is designed to handle and analyze large volumes of transactional data, customer behavior records, and external datasets such as credit scores and blacklists. It relies on a combination of technologies to manage different types of data:

- Databases. MySQL or PostgreSQL for structured data; MongoDB and Cassandra for unstructured data.

- Data lakes. AWS S3, Azure Data Lake, and Google Cloud Storage.

- Big data frameworks. Apache Hadoop or Apache Spark.

- Data warehouses. Snowflake, Google BigQuery, or Amazon Redshift.

Real-Time Data Processing

The goal is to process transactions in real time and detect fraud as it occurs, stopping fraudulent actions in their tracks.

- Stream processing. Apache Kafka, Apache Flink, or Amazon Kinesis.

- In-memory data grids. Redis or Apache Ignite.

- Event-driven architecture. RabbitMQ or Apache Pulsar.

Machine Learning and AI Frameworks

The goal is to leverage AI and machine learning techniques to implement fraud detection, anomaly detection, and pattern recognition algorithms.

- ML libraries and frameworks. TensorFlow, PyTorch, or Scikit-learn.

- AI-powered fraud detection platforms. DataRobot or H2O.ai.

- Cloud AI services. AWS SageMaker, Google Cloud AI, or Azure AI.

- AutoML. Google AutoML, Azure AutoML.

Behavioral Analytics and Biometrics

The main objective is to monitor user behavior patterns while leveraging biometrics for identity verification and fraud prevention.

- Behavioral analytics platforms. Featurespace, SAS Analytics, or FICO Falcon.

- Biometric authentication. Libraries like OpenCV (for image processing) or biometric APIs by BioID or iProov.

Fraud Detection Models and Algorithms

The objective is to develop detection algorithms by leveraging statistical models, machine learning techniques, and rule-based approaches.

- Anomaly detection algorithms. Isolation Forest, One-Class SVM, or DBSCAN.

- Supervised learning algorithms. Logistic regression, decision trees, random forests, and gradient boosting (e.g., XGBoost, LightGBM).

- Unsupervised learning algorithms. K-means clustering, PCA, and autoencoders.

Risk Scoring and Rules Engines

The goal is to assess the risk of transactions, generating fraud alerts or prompting additional verification when necessary.

- Rules engines. Drools, Red Hat Decision Manager, or FICO Blaze Advisor.

- Risk scoring platforms. Custom-built scoring engines, integrated with transaction monitoring systems.

API Integration

To enable integration with external fraud detection services, identity verification providers, and payment gateways.

- External fraud detection APIs. LexisNexis ThreatMetrix, Experian Fraud Detection, or Feedzai.

- Banking APIs. RESTful or GraphQL APIs.

- Webhooks. Webhooks to provide instant alerts.

Identity Verification and Authentication

The goal is to verify customer identities through multi-factor authentication (MFA) and Know Your Customer (KYC) procedures.

- Multi-factor authentication (MFA). Twilio Authy, Okta, or Duo Security.

- KYC and identity verification. Jumio, Onfido, and ID.me.

- OAuth and SSO. OAuth 2.0, SAML, and OpenID Connect protocols.

Security and Encryption

The primary goal is to safeguard customer data and facilitate secure transactions. To achieve this, several key technologies are utilized:

- Data encryption. AES-256, RSA, and TLS techniques.

- Tokenization. Cybersource or Stripe.

- Public key infrastructure (PKI). An ecosystem for digital certificate management.

Cloud Infrastructure

To support fraud detection operations, it’s crucial to build infrastructure that can scale efficiently, offer flexibility, and ensure security.

- Cloud providers. AWS, Microsoft Azure, or Google Cloud.

- Serverless architectures. AWS Lambda, Azure Functions, or Google Cloud Functions.Containerization and orchestration: Docker, Kubernetes, or OpenShift.

Blockchain and Distributed Ledger Technology (DLT)

The main goal is to ensure that transactions remain immutable and transparent, effectively preventing tampering or fraudulent modifications. This is achieved through the use of advanced technologies.

Blockchain frameworks. Hyperledger, Ethereum, and Corda.

Distributed ledgers. A secure, tamper-resistant method for storing transaction data.

How Long Will It Take to Implement Custom Fraud Detection Software in Banking?

Implementing custom fraud detection software in banking typically unfolds over several phases—each playing a crucial role in the system’s overall success. These phases generally include planning, design, development, testing, and deployment. The exact duration of each phase can vary significantly depending on the system’s complexity, the bank’s size, integration requirements, and specific regulatory obligations. Below is an in-depth look at each phase, along with estimated timeframes:

Planning and Requirements Gathering (1-3 Months)

Define the project scope by focusing on the bank’s fraud detection needs, such as card fraud and money laundering. Conduct a risk assessment to prioritize fraud types. Ensure compliance with AML, KYC, GDPR, and PSD2 regulations. Finally, key data sources like transaction histories and behavioral data should be identified to support machine learning and monitoring efforts.

System Architecture and Design (2-4 Months)

Design the system architecture, focusing on data pipelines and transaction monitoring. Position AI and machine learning models to ensure scalability. Integrate the system with banking platforms, including core systems, payment gateways, and APIs for AML/KYC. Finally, choose a technology stack with the right cloud infrastructure, databases, and AI tools to ensure high performance and scalability.

Development and Integration (6-12 Months)

Build the fraud detection system with real-time monitoring, anomaly detection, and risk scoring models. Integrate machine learning for continuous updates and create custom algorithms for new patterns. Ensure seamless integration with banking systems and third-party APIs for KYC and AML. Set up real-time data pipelines and develop a user-friendly UI for fraud analysts.

Machine Learning Model Training and Data Preparation (3-6 Months Overlapping)

Start by collecting and cleaning historical transaction data to train machine learning models. Develop models for fraud detection, such as anomaly detection, behavioral analysis, and risk scoring. Test these models on real or synthetic data to ensure they accurately identify fraud. Continuously refine them to minimize false positives and negatives.

Compliance and Regulatory Certification (2-4 Months Overlapping)

Ensure the detection system adheres to all relevant regulatory frameworks, including AML, KYC, GDPR, and PSD2. Regularly perform internal and external audits to confirm compliance with privacy and security laws. Secure the required certifications and approvals from regulatory authorities.

Testing and Quality Assurance (3-6 Months)

Conducted unit, system, and integration testing to confirm that all components functioned correctly. Follow this with stress testing to ensure the system can efficiently manage high transaction volumes in real-time. Test machine learning models in live environments, tweaking algorithms as necessary based on their performance. Simulate different types of fraud scenarios to assess the effectiveness of the detection models. Finally, verify that the system promptly generates accurate alerts, minimizing false positives.

Pilot Deployment and Refinement (2-3 Months)

Deploy the system in a controlled environment during the pilot phase to test real-world transactions. Collect feedback from fraud analysts and users regarding system performance and overall usability. Continuously monitor the system’s performance, adjusting detection algorithms and fine-tuning risk scoring models. Resolve any issues or bottlenecks that arise throughout the pilot phase.

Full Deployment and Rollout (1-2 Months)

Deploy the fully operational fraud detection system across all banking platforms—online, mobile, ATMs, and in-branch services. Provide comprehensive training to staff, ensuring they understand how to use the system, track fraud alerts, and handle any suspicious activity that arises. Implement ongoing support and maintenance procedures to guarantee the system remains efficient and trouble-free post-launch.

Factors That Can Speed Up or Delay the Implementation

The pressure to develop efficient fraud detection systems is higher than ever. But what sets apart a smooth, speedy development from one bogged down by delays? The secret often lies in balancing well-defined goals with agile strategies and overcoming the inevitable obstacles like legacy systems or regulatory hurdles. Below, we explore the key factors that can either fast-track or hinder the development process, so you can stay ahead of the curve.

Factors that can speed up the process

- Clear requirements. Having a firm grasp of fraud risks and regulatory expectations can streamline development.

- Agile methodology. An agile, iterative approach helps teams roll out features gradually, allowing faster improvements.

- Use of existing tech. Utilizing ready-made tools or frameworks (like machine learning libraries or cloud services) reduces development time.

- SaaS solutions. Outsourcing features like KYC or AML to SaaS providers reduces the complexity of building custom solutions.

Factors that can delay the process

- Legacy system integration. Working with outdated or intricate legacy systems can slow things down considerably.

- Regulatory challenges. Dealing with regulatory complexities, especially across global banks, can create bottlenecks.

- Excessive false positives. If the fraud detection models initially produce too many false alarms, tweaking and retraining them can extend timelines.

- Data issues. A lack of clean, historical transaction data for training models can result in significant delays.

Total

Developing and implementing custom fraud detection software in banking is a complex and time-consuming process, generally taking 12 to 24 months. Banks must consider the trade-offs between building a custom solution and opting for an existing SaaS-based solution, especially if time-to-market is a key consideration. Custom solutions provide more flexibility and control but require significant resources and expertise to develop, test, and deploy.

Conclusion

Fraud detection tools have become a cornerstone of financial security and regulatory compliance in today’s fast-changing digital environment. As online and mobile banking grow, along with increasingly sophisticated fraud techniques, banks must turn to cutting-edge technologies such as AI, machine learning, and real-time data analysis to stay one step ahead of financial criminals. While Software-as-a-Service (SaaS) solutions offer quick deployment and lower initial costs, custom-built systems provide more flexibility, control, and customization to meet a bank’s particular needs.

Banks can select the right fraud detection solution to safeguard their assets and customers by carefully assessing their specific requirements, regulatory mandates, and operational challenges. Whether they choose a ready-to-deploy SaaS platform, or invest in a custom-built system, the essential factor is ensuring that the solution can scale with the bank’s growth, adapt to evolving fraud tactics, and maintain strong security measures—building trust in the broader financial ecosystem.

At IntelliSoft, we know how to help you! Contact us today to get a free consultation.