Artificial intelligence has significantly affected various industries, including finance. Its inception has transformed how enterprises operate and provide services to their customers. Integrating AI and machine learning in banking services has made this sector more customer-oriented and advanced.

AI banking systems help financial organizations reduce costs by boosting productivity and making decisions based on data that would be impossible for a humans to process. Moreover, these intelligent algorithms play a crucial role in the banking sector by swiftly identifying and flagging fraudulent information, thereby enhancing the security of financial operations.

AI in banking and payments sector has enormous potential to improve efficiency, service, and productivity while reducing costs. Business Insider and McKinsey reports suggest that the industry could benefit from AI by as much as $1 trillion. In this article, we will explore how AI is applied in different sectors and how it is transforming customer experience with its numerous benefits.

Table of Contents

AI in Banking Statistics

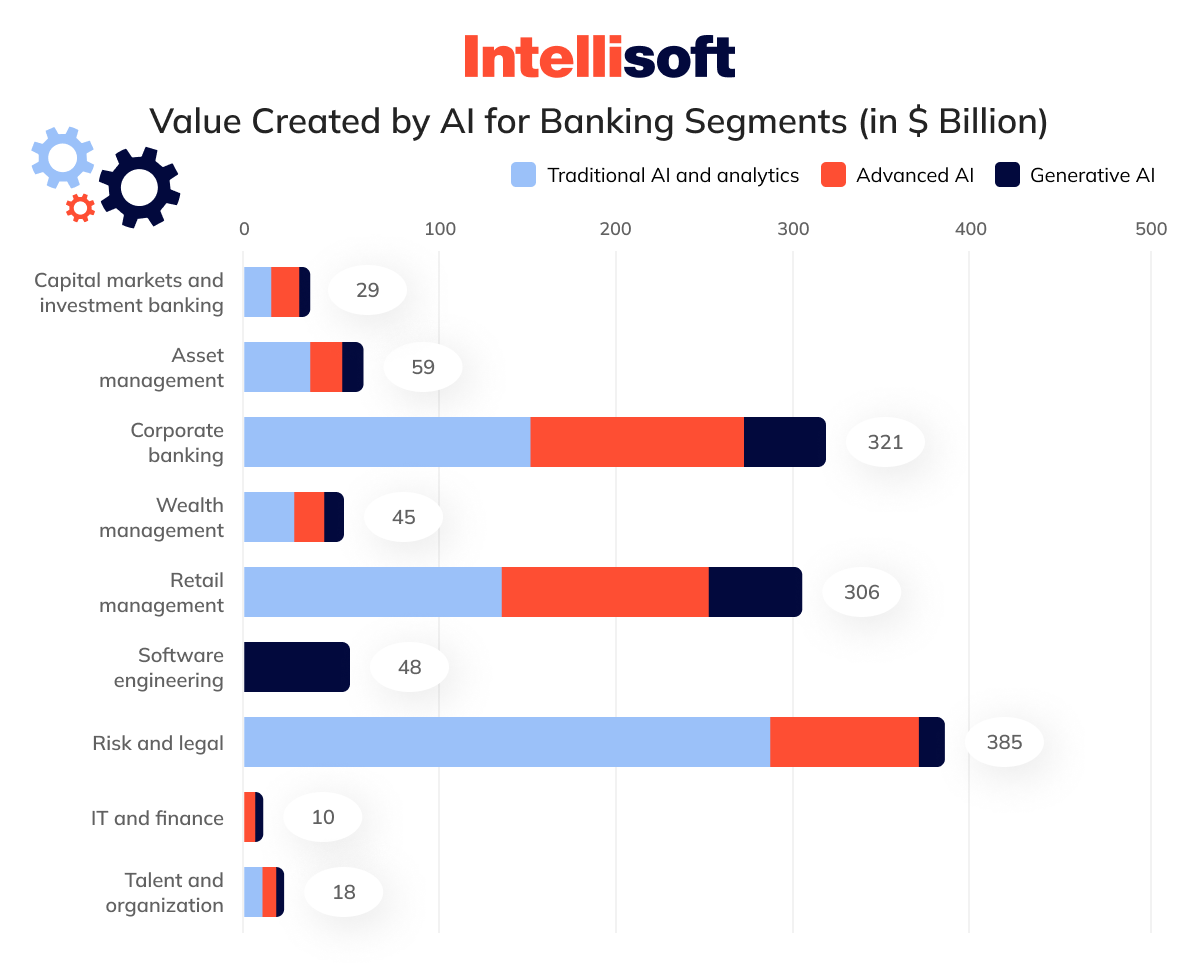

According to the analysis conducted by the McKinsey Global Institute, the implementation of gen AI across various industries has the potential to add an annual value of $2.6 trillion to $4.4 trillion. This artificial intelligence in banking case study looked at 63 use cases and estimated that banking is one of the sectors that could benefit the most, with a possible annual value of $200 billion to $340 billion. This data indicates a productivity increase of 9 to 15 percent, resulting in a boost in operating profits.

The positive effects of generative AI in banking industry will spread across all segments. The corporate and retail sectors reap the most significant gains, amounting to $56 billion and $54 billion, respectively. While productivity has been the primary focus of banks during their initial gen AI pilots due to the current pressure on economics, the technology has the potential to revolutionize the way specific jobs are performed and how customers interact with financial organizations. In fact, it could even lead to the development of entirely new business models.

Applications of AI in Banking and Finance

Artificial intelligence has emerged as a highly significant technology with immense potential. One of the industries that has been quick to realize its benefits is banking. Numerous banks worldwide have adopted AI technology to boost their products and services. AI and banking have brought about significant changes in how financial organizations operate and serve their customers.

Cybersecurity and Fraud Detection

Digital transactions have become an integral part of our daily routine. We use various apps and online accounts to pay bills, withdraw money, deposit checks, and perform many other financial activities.

Consequently, the banking sector is facing a growing challenge to improve its fraud detection capabilities.

Artificial intelligence plays a crucial role in addressing this challenge. By leveraging AI banking, financial organizations can:

- Identify and prevent fraudulent activities

- Find vulnerabilities in their systems

- Reduce risks

- Improve the overall security

An excellent illustration of AI implementation in fraud detection is seen in Danske Bank, Denmark’s largest bank. Using a deep learning-based fraud detection algorithm, the bank significantly improved its fraud detection capability by 50% and reduced false positives by 60%. Additionally, the AI-based system automated many critical decisions while routing certain cases to human analysts for further review.

In 2019 alone, almost a third of all cyber attacks were directed at financial organizations. AI can provide financial institutions with a proactive defense against cyber-attacks by employing advanced monitoring and threat detection algorithms. With AI’s continuous monitoring capabilities, banks can detect and respond to potential threats before they cause any damage to the organization’s internal systems or its customers.

Chatbots

Chatbots are one of the greatest examples of artificial intelligence in banking industry. They are available 24/7 and continuously learn about individual customer behavior. This approach allows them to provide efficient and personalized customer support, reduce the workload on other communication channels, and recommend relevant financial services and products.

Integrating chatbots into banking apps ensures that customers can find help anytime. One notable example of conversational AI in banking apps is Erica, the virtual assistant from Bank of America. Erica efficiently manages credit card debt reduction and updates card security. In 2019, this chatbot processed over 50 million client requests.

Loan and Credit Decisions

Banks increasingly integrate AI-based systems into their processes to enhance the accuracy, safety, and profitability of their loan and credit decisions. While many financial organizations rely heavily on credit history, credit scores, and customer references to assess creditworthiness, these traditional credit reporting systems often contain errors and may not provide a complete picture of an individual’s or company’s financial behavior.

AI-based loan and credit systems can analyze customer behaviors and patterns to assess creditworthiness better. They can even review cases with limited credit history. Moreover, merging AI and banking can develop systems can alert banks to specific behaviors that may indicate an increased risk of default.

Tracking Market Trends

The financial services industry is experiencing a significant shift thanks to advances in AI and ML technology. Banks are increasingly relying on these powerful tools to process large volumes of data and make accurate predictions about market trends. The application of advanced ML techniques in finance has not just enabled financial organizations to evaluate market sentiments, but also to offer personalized investment options to their clients, thereby enhancing decision-making in the industry.

Generative AI in banking also provides real-time insights and analytics that enable banks to make informed decisions about when to invest in stocks and avoid potential risks. This emerging technology’s high data processing capacity has significantly accelerated decision-making and made trading more convenient and efficient for both financial institutions and their clients.

Data Collection and Analysis

Every day, finance institutions handle an enormous volume of transactions, making it overwhelming for employees to collect and record such a huge amount of data without errors. In such scenarios, artificial intelligence in banking and finance can efficiently collect and analyze data, leading to improved user experience. Moreover, the information can be utilized for fraud detection and making credit decisions.

Customer Experience

Customers today are increasingly seeking improved experiences and greater convenience. Take ATMs, for example, which became popular because they allowed customers to carry out essential transactions such as depositing and withdrawing money outside of traditional banking hours. This level of convenience has sparked further innovation in the industry. Nowadays, customers can open bank accounts from their homes using their smartphones.

Integrating AI in banking and finance has significantly enhanced the consumer experience and increased user convenience in the following ways:

- AI technology has streamlined processes such as recording Know Your Customer (KYC) information, reducing time and errors. Moreover, it has facilitated timely releases of new products and financial offers.

- Automation through AI has revolutionized the eligibility process for services like applying for a personal loan or credit, eliminating the need for manual intervention and streamlining the entire process. Furthermore, AI-based software has reduced approval times for services like loan disbursement.

AI in banking has revolutionized customer service by enabling accurate capture of crucial client information during account setup, eliminating errors that could affect the customer experience. AI-powered assistants ensure a seamless and personalized customer journey that boosts customer satisfaction and loyalty.

Risk Management

External factors such as currency fluctuations, natural disasters, and political unrest can have a significant impact on decision-making in business, requiring financial organizations to exercise caution and prudence during times of volatility. The introduction of generative AI services in the banking industry has provided businesses with a powerful tool. These AI tools not only offer insights into future trends, but also help businesses stay prepared, enabling them to make informed decisions ahead of time.

Moreover, artificial intelligence in banking has enabled banks to analyze their clients’ past behavioral patterns and smartphone data to assess the likelihood of a loan default. This predictive analysis has proven effective in identifying high-risk loan applications, thereby minimizing the risks associated with lending. AI in banking has revolutionized the industry and is helping businesses make smarter, data-driven decisions.

Regulatory Compliance

Banking is an industry that involves a high degree of regulation worldwide. Regulatory authorities have the responsibility to ensure that financial institutions are not being exploited for illegal activities such as money laundering and to ensure that they maintain acceptable levels of risk to minimize the possibility of large-scale defaults.

Traditionally, banks have relied on internal compliance teams to tackle these issues, but these processes are time-consuming and require significant investments when performed manually. Moreover, compliance regulations are subject to frequent changes, and banks must continuously update their processes and workflows to stay compliant.

The implementation of AI and machine learning in banking involves the use of deep learning and NLP to comprehend the new compliance requirements for financial institutions. This approach, in turn, enhances their decision-making processes. AI cannot completely replace compliance analysts, but it can make their operations much faster and more efficient.

- Automating repetitive tasks

- Reducing errors

- Enabling real-time big data monitoring and analysis

Predictive Analytics

The collaboration between banking and AI can be a game-changer, as it allows for powerful semantic and natural language applications coupled with predictive analytics. AI can analyze data in a way that traditional technology cannot and can identify specific patterns and correlations that might otherwise remain hidden. This approach, in turn, can uncover previously untapped sales opportunities and cross-selling possibilities and provide valuable insights into operational data. The impact of this can be directly seen in the revenue generated by the bank.

Process Automation

RPA and AI in banking are revolutionizing business operations by providing a highly efficient and cost-effective way to automate repetitive tasks. With RPA, financial organizations can dramatically reduce the time and effort required for manual tasks, allowing employees to focus on more complex processes that require human involvement.

Financial organizations increasingly turn to RPA and AI in banking to streamline operations and improve transaction speed in the financial sector. For example, JPMorgan Chase has developed a cutting-edge RPA technology called CoiN that utilizes advanced algorithms to review documents and extract essential data much faster than humans can. This approach has helped the bank reduce processing times and improve efficiency across key operations.

Related articles:

- Generative AI Use Cases: Benefits and Real-life Examples

- How to Build an AI App from Scratch

- How to Choose between Machine Learning vs Predictive Analytics

- Best programming languages for AI and machine learning solutions

- Why GPT-3 Chatbot from OpenAI Is A Game Changer for Businesses?

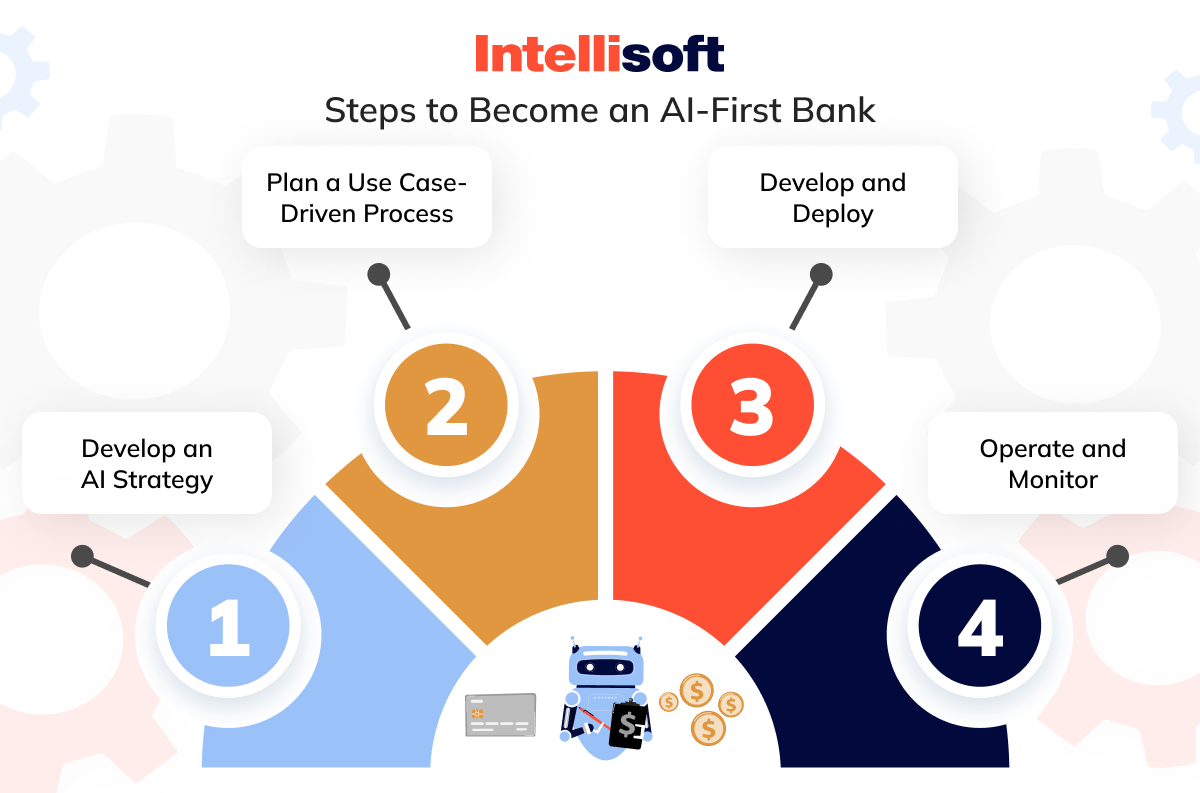

Steps to Become an AI-First Bank

In the previous section, we explored the use of AI in banking and finance sector. And now, we will delve into the crucial steps that banks need to undertake to implement AI on a large scale and transform their existing processes. However, you should remember the four essential factors of the successful adoption of AI in banking: people, governance, process, and technology.

Step 1: Develop an AI Strategy

When a financial organization implements artificial intelligence (AI) into its operations, it should develop an AI strategy aligning with its goals and values. To do this, the company must conduct internal market research to identify any gaps that AI technology can fill in people and processes. This research will help the company better understand how AI can be leveraged to improve its business operations.

Moreover, the AI strategy adheres to industry standards and regulations established by regulatory bodies. For example, banks may assess current international industry standards to ensure their AI strategy aligns with industry best practices. This adherence is essential to guarantee the company’s legal and ethical compliance during AI technology implementation.

Finally, the company must refine internal practices and policies related to talent, data, infrastructure, and algorithms to ensure it is prepared to adopt AI banking safely and effectively. This process stage will provide clear directions and guidance for adopting AI that aligns with the company’s overall strategy and goals.

Step 2: Plan a Use Case-Driven Process

You should follow a well-defined plan to merge AI and banking sector successfully. The first step involves identifying potential AI opportunities that align with the bank’s processes and strategies. This approach requires careful consideration of the bank’s current operational processes and identifying areas where AI solutions could add the most value.

Once potential use cases are identified, the QA team should conduct comprehensive feasibility checks to evaluate their implementation. This method involves meticulously assessing all aspects of the proposed solution, leaving no stone unturned to identify gaps that need to be managed. Based on this review, the team should confidently select the most feasible cases to move forward with.

The last step in the planning stage is to map out the AI talent required to develop and implement generative AI in banking solutions. Financial organizations need several experts, including algorithm programmers and data scientists, to successfully leverage AI. If the bank does not have in-house experts, it can outsource or collaborate with an AI technology provider to ensure it has the necessary expertise.

Step 3: Develop and Deploy

After carefully planning, banks must move on to execute the process of building AI for banking and finance. However, before creating a full-fledged AI system, it is crucial to build prototypes to identify the potential shortcomings of the technology. These prototypes must be thoroughly tested to accomplish this task; financial organizations must gather relevant data and feed it to the algorithm. The AI model then trains and builds on this data, so the data’s accuracy is paramount.

After developing an AI model for finance organizations, testing the model’s interpretation of results is essential. This testing phase is crucial as it helps the team understand how the model will perform in the real world and identify any necessary improvements.

Once the testing is complete, the finance organization can deploy the trained model. As production data starts pouring in, the model’s effectiveness and efficiency can be regularly monitored and updated. This approach ensures that the model remains relevant and effective in handling the ever-changing financial landscape.

Step 4: Operate and Monitor

As the world becomes more technologically advanced, implementing generative AI in banking and finance industry becomes more prevalent. However, banks must remember that AI models require continuous monitoring and calibration to ensure their effectiveness. This approach means designing a review cycle that comprehensively evaluates the AI model’s functioning to help manage cybersecurity threats and provide a robust execution of operations.

The continuous flow of new data will impact the AI model during operation. Therefore, financial organizations must take appropriate measures to ensure the quality and fairness of the input data.

How IntelliSoft Can Help in Your AI for Banking Journey

The integration of artificial intelligence with the banking industry has proven to be a perfect match. The technology’s numerous benefits have allowed financial services companies to implement at least one AI capability to streamline their business processes, as indicated by the global AI survey report by McKinsey. These staggering 60% of institutions that have already adopted AI solutions reveal that the future of AI in banking is bright and promising.

AI technology has immense potential to revolutionize the banking landscape by minimizing errors, enhancing customer experience, and streamlining operations. With such capabilities, all finance institutions must invest in AI solutions to offer customers novel experiences and excellent services. The use of AI in banking is a remarkable step towards improved efficiency and better customer satisfaction.

IntelliSoft is a leading artificial intelligence services company that offers high-end FinTech software development services for financial institutions. For 15 years, we have developed custom AI and machine learning models that reduce costs, mitigate risks, and improve revenue in different departments.

Our team of IT consulting experts is well-versed in artificial intelligence and has a keen understanding of the specific challenges encountered by the banking industry. We can help you create AI banking solutions to enhance risk management, automate procedures, and improve customer experiences.

Contact our experts today to ensure that you benefit from AI in the most tech-friendly manner possible. We will collaborate with you to create and execute a long-term plan for implementing artificial intelligence in banking to meet your specific needs.

Conclusion

One of the most pressing challenges in integrating banking services with third-party AI solutions is ensuring the protection of client data. The banking industry is well-known for its unwavering commitment to protecting vulnerable data and operations, which makes it essential to pay meticulous attention to the integration process.

Selecting an AI-powered solution that meets the industry’s high-security standards requires the expertise of a professional team with extensive knowledge in AI development. Moreover, financial organizations must ensure that the interface that links their apps with AI is efficient and fortified with extra security measures to protect user data.

Preparing an AI model to cater specifically to the intricacies of the banking industry is a significant challenge. The language and context within the finance sectors are unique, necessitating thorough technology training with pertinent and up-to-date data. Inadequate training may result in the AI providing insufficient responses to user queries, which could lead to avoidable errors and complications. Therefore, preparing AI for the nuances of fintech operations is essential to mitigate such scenarios.