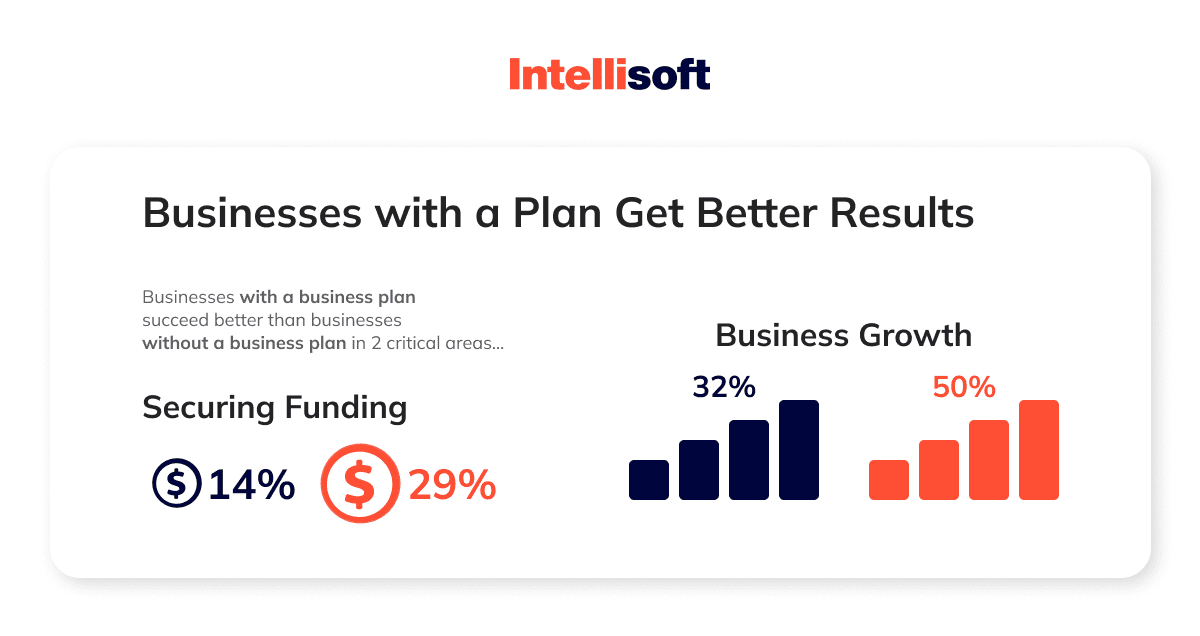

The modern IT world dictates new trends, and, as most of you have probably noticed, the future of business today is startups. The minds of talented entrepreneurs are busy with how to turn their idea into a profitable business, make their startups competitive, and attract large investors for their implementation. In practice, almost 90% (!) of startups fail. These dramatic statistics are influenced by several factors, including a poorly written business plan.

Companies with business plans also see higher growth rates than those without a plan. Learn how to make and calculate a business plan for an enterprise properly.

Table of Contents

What Is a Business Plan?

For effective implementation of any business idea, you need a business plan. A business plan is a feasibility study of a business in market conditions. It defines the enterprise model in the future. Simply put, a business plan is a document that defines the goals of your business and describes how to achieve them.

The business plan should answer important questions like, “Is it worth investing money in this product/service?” “Is it worth it for the bank to give money to implement the project?” “Should an entrepreneur open such a business?” “Is it worth expanding the enterprise or producing a new product?”

5 Main Purposes of Business Planning

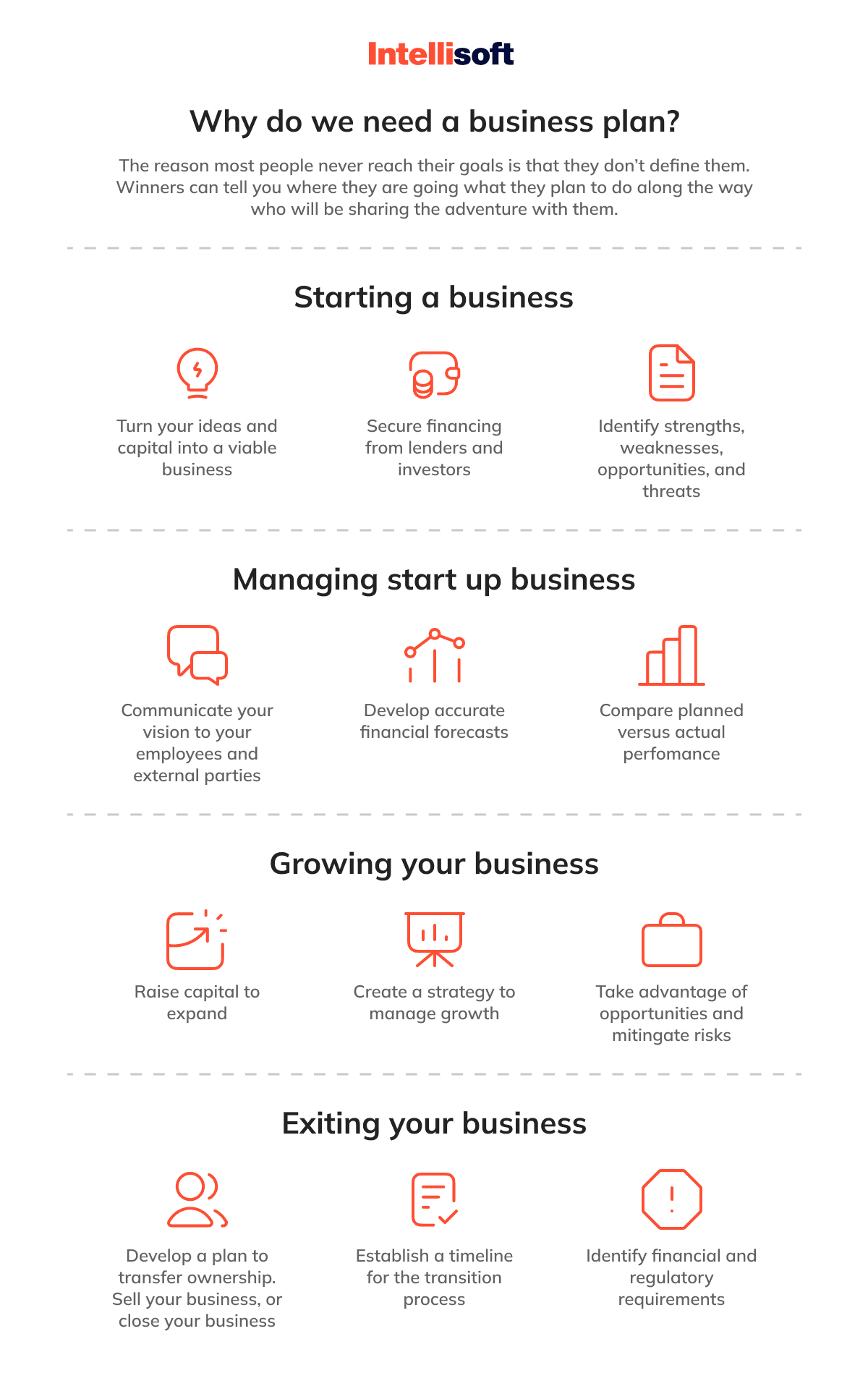

While writing a business plan, entrepreneurs look for future reserves to reduce costs and increase revenues to ensure the growth of the company’s profits. In the process, identify strengths, weaknesses, opportunities, and threats (SWOT analysis). In addition, keep these aspects in mind to maximize the advantages of the firm and minimize the drawbacks. This helps to reduce entrepreneurial risks.

You might also like:

- From Idea to Prototype: Build a Mobile App from Scratch

- Guide on How to Write Proper Software Requirements Specification (SRS)

- What Does Technology Stack Mean?

- Story Point to Hours: Which Estimation Approach to Choose?

- From Concept to Creation: How to Master the Discovery Phase of Product Development

Types of Business Plans

There are five main types of business plans: internal, for investors, for obtaining a bank loan, for getting state support, and anti-crisis.

- Writing a business plan for yourself (internal)

Such plans are intended solely for internal use, so they are usually drawn up in any form, formal or informal. The main purpose of the work is to understand and assess the prospects and risks of the project. - Writing a business plan for investors

The purpose of drafting this one is to attract external financing for the project’s implementation. Foreign investors, as a rule, require the business plan to be created in accordance with international standards UNIDO, and below, we will discuss it in detail. - Business plans for getting bank loans

The form of the document and the requirements for a business plan are better clarified with a credit consultant: methodological recommendations differ from bank to bank.

If you are preparing a business plan to apply to several creditors at once, you should be guided by UNIDO international standards. Most bank requirements are based on these standards so that you will have a more or less universal document. If necessary, you can relatively easily adapt it to a particular lender’s requirements.

Set yourself up for long work ahead of time: the business plan will most likely have to be edited several times. Consideration of credit deals is often delayed, and conditions change on the fly. You have to adjust the terms of the project, the cost of equipment and raw materials, selling prices, credit parameters, and other indicators. - Business plans for state support

There are many state programs to support small businesses and startups. For example, they help agricultural manufacturers, beginning entrepreneurs, and unemployed citizens who want to start their own businesses.

As a rule, to receive subsidies, you have to submit a business plan. The requirements are to be found in the documentation of the specific state support program. It is important to consider all these requirements: if you submit a business plan lacking any of them, the application for participation risks being rejected. - Anti-crisis business plans

Anti-crisis business plans are developed for companies in a difficult financial situation—pre-bankruptcy or bankruptcy. The main goal is to explain to creditors how the company is going to come out of the crisis, as well as offer alternatives for settling disputes in court and pre-trial proceedings.

Basic Tips from Our Experts for Writing a Business Plan

We have spent plenty of time on preparing plans for businesses ourselves, so we realize how it should look. Experts from IntelliSoft are ready to share tips and tricks that will help you learn how to create a business plan that will win.

Know your audience

Write your business plan assignment in a way that your target audience will understand. For instance, if your business is in the healthcare industry and you want to attract investors, make sure the content is tailored to their needs.

Here’s an illustration of too complicated language:

“For CIPAP machines, our solution consists of a component device with a single connection. Our product provides non-intrusive, dual-pressure ventilation when connected to a CIPAP device.”

At least do not forget to interpret your unique abbreviations! Simplified wording:

“Our product is an easy-to-use device that replaces traditional medical ventilators and does not require an electrical connection. The cost of our product is 1/100 that of a traditional ventilator.”

Doesn’t it sound way better now? In other words, target investors. Pretend you are an average customer and explain how they can benefit, like in the example above.

Be concise

Your business plan must be concise and brief. This condition is necessary for two reasons:

- Your business strategy should compel the reader to finish reading it. For instance, who wants to waste time on a document that is 40 pages long?

- The business plan should develop along with your firm as a tool for corporate growth and development. It’s more challenging to edit and work with a long document.

Define your objectives

Suppose you have the idea of setting up your own healthcare start-up. Decide what your goal will be for the next 3-5 years: launch an MVP, hire full-time software developers, attract 100+ clients, etc.). Specifying the goals will help to show the investor what kind of profit he can count on, and it will help the company to see its possible prospects and build step-by-step moves toward them.

Look at a sample business plan

It’s best to review a sample business plan for a company in your industry (IT, app development, law firm, etc.) before you start writing your own document. You may also use hundreds of free online templates to learn how to write a business case.

You’ll be able to comprehend how it ought to appear, how calculations ought to be done correctly, what should go in the business plan, the quirks of the sector, etc. By searching for terms like “business plan for a healthcare start-up” or “business plan for a law firm,” you can find lots of examples online.

Use free and paid tools and apps

Learn and apply modern tools and techniques when analyzing markets, describing a business model for startup, and discussing teamwork. Call consultants to solve business problems, not just to write a doc or conduct a training session. Just check the web—you may find such solutions as Miro, SBA, Bplans, LivePlan, and more are available.

Study industry averages

This is especially useful for newcomers because the data can help convince an investor of the prospects and foresee their own mistakes in advance. Still, it is not always possible in our dynamic world: pioneers in robotics or artificial intelligence (AI), for example, have no one to compare themselves with.

The budget

Start with describing the capital requirement to allocate your funds and understand how much you need. You may provide data on expenses and profits along with other indicators and formulas. However, in the end, the investor still cannot understand how much capital is needed and how the startup will distribute it. You have to state how you see the investor’s involvement in your project. Use an executive summary section for this purpose. Also, learn to distinguish between cash flow and profit.

Use SWOT Analysis in Business Planning

SWOT analysis helps to understand what external and internal environmental factors influence the company. SWOT is an acronym that stands for:

- S – strengths – the strengths thanks to which the company stands out from its competitors.

- W – weaknesses – shortcomings which prevent the company from increasing its output and market share.

- O – opportunities – opportunities that can improve the market position.

- T – threats – risks and concerns the company may face.

The essence of this analysis is that all factors that can affect the company are evaluated and categorized into four groups. The SWOT analysis is universal, flexible, and simple, but there are certain disadvantages, like the subjectivity of assessments and the lack of numerical indicators.

Identify the strengths and weaknesses of your project. Suppose we open an IT hub in a small town with a population of 100 thousand. We have done our research and found that our strengths are:

- Location of the center

- A large area of the premise

- Building equipped with up-to-date tools

- A wide range of services (e.g., our competitors have only space for developers, but we also have gaming rooms and a cafeteria)

As for the potential weaknesses, we define the following: competitors with cheaper services, the client base to be built from scratch, and a lack of knowledge about us.

Identification of opportunities and threats. Let’s assume that the main opportunities of the project are:

- Growth of the market for similar services

- Widespread propaganda in favor of software development

- Formation of the positive image

- Replacement of the competitor’s market share by the client overflow

Meanwhile, the dropbacks involve the emergence of new competitors and a decline in the population’s income.

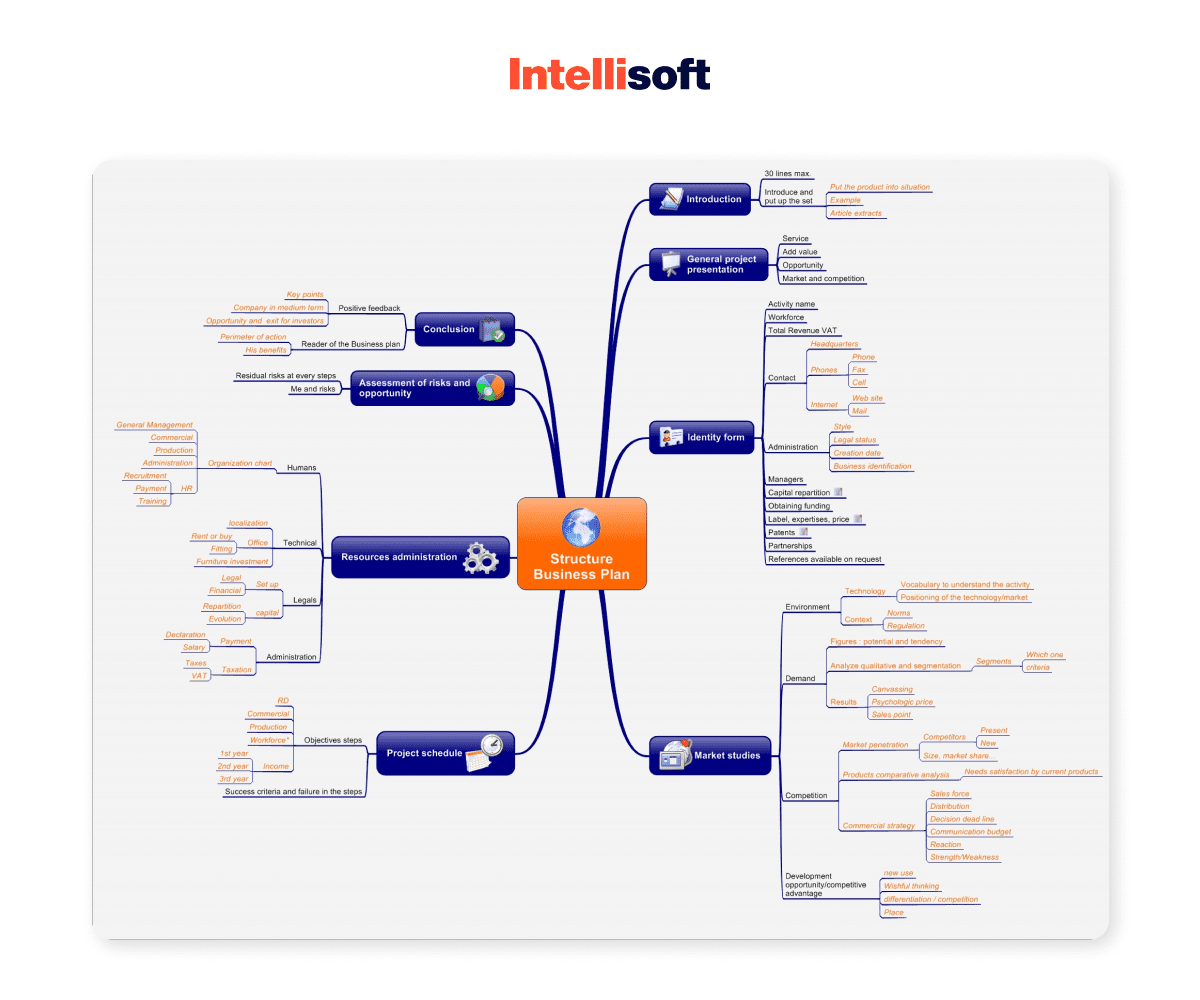

What to Include in a Business Plan?

We suggest that you get acquainted with the structure of business plan according to the UNIDO standard. UNIDO (United Nations Industrial Development Organization) is an organization that offers business planning standards, fighting for global prosperity by supporting the industrial development of developing countries and underdeveloped countries.

N.B. At the end of this section, where we describe a standard business plan, you’ll find a template for writing a plan for a tech start-up, so let’s make it to the end!

- A title page

The title page should contain the project’s name, organization, project manager’s (PM) name, date of compilation, other data (amount of investment in the project, amount of bank financing, etc.), and information about the company or plan’s author.

The executive summary is considered the most important part of the business plan. By having a single look at it, potential investors can understand whether the project will suit them. It briefly describes the company and its goals, explaining why the business idea will be successful.

If you are interested in attracting funds, the executive summary will act as a hook to grab the attention of a potential investor—just like intriguing headlines in your favorite magazines or newspapers.

The summary points out the advantages of the entire business plan. This section is written in the last turn once the document’s main body is done.

A summary should cover several points:

Mission and main objectives. It is necessary to explain what the business does in several sentences or a single paragraph.

Information about the company. Briefly describe when the company was founded, indicate the names of the founders and their roles, the number of employees, and the business location.

Key points of business growth. Include the company’s growth indicators, financial indicators, and market share. Graphs, pie charts, and other visual elements will be appropriate in this section.

Products/Services. Briefly describe the products or services the company offers.

Information about your financial condition. If you are seeking financing, include any information about investors or banks.

Future plans. Explain what you want your business to be in the future.

All information in your resume should be succinct. The summary is the first part of the business plan that people will see, so every word in it should be appropriate.

- Company information

This section includes an aggregated analysis of the various business elements. It helps potential investors quickly understand the company’s objectives and its unique offering in the market.

Contents of the section:

- Describe the type of business and list the market needs the company wants to satisfy.

- Explain the company’s products and services that meet those needs.

- Name the customers, organizations, or businesses that the company will serve.

- List your company’s competitive advantages.

- Description of products/services

Describe your project as deeply as possible. Add a photo of the product or a screenshot of your service. When describing a product or service, you must provide the next information:

- Product/Service name

- Field of application

- Qualities of the product or service

- Availability and necessity of patent, copyright, license, quality certificate, etc.

- Terms of delivery and packaging

- Warranty and service

- Conditions & terms of use

- How you can dispose of the product

In addition, be sure to write at what stage your product is—development, readiness to sell, etc.

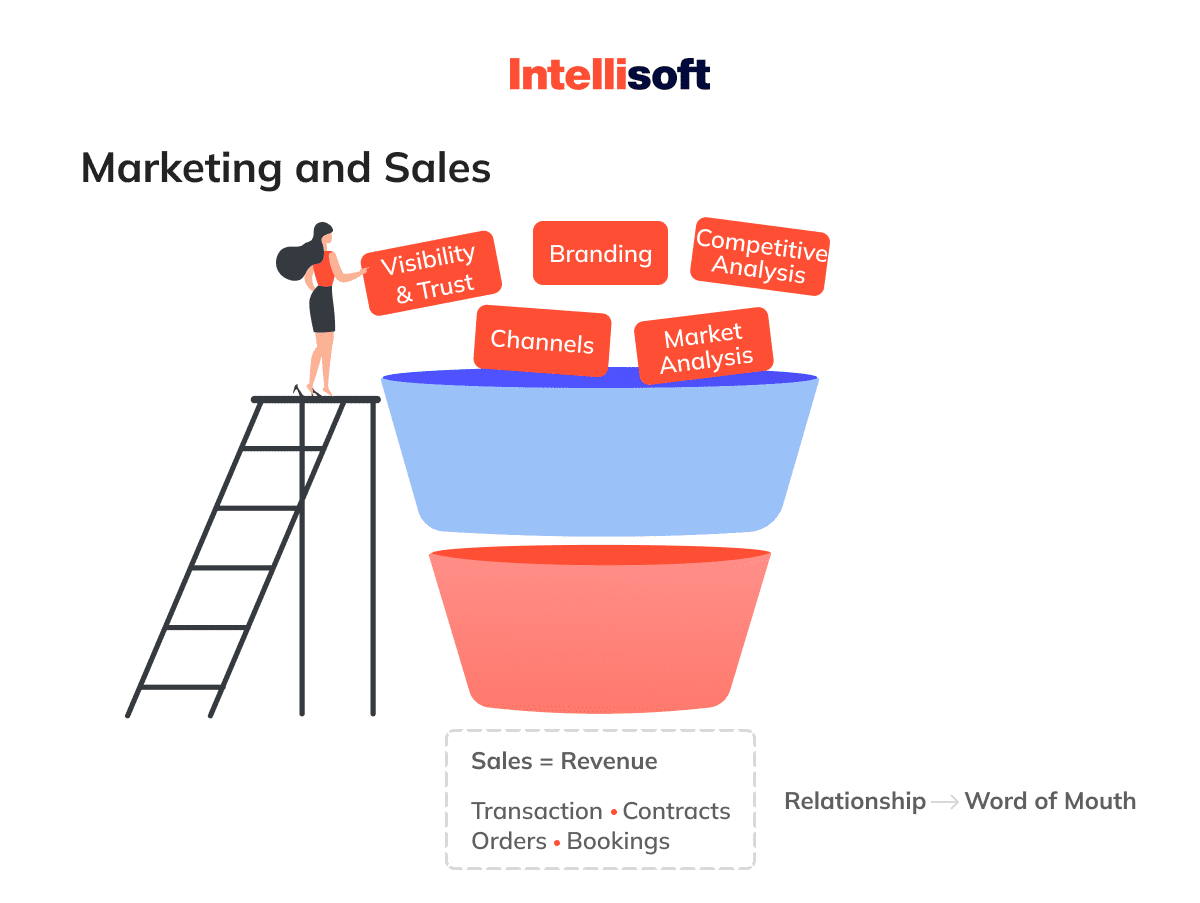

- Marketing & sales

This section defines the marketing strategy. The content of the section includes four important blocks:

Market penetration strategy. It’s how a company (that already exists in the market with a product) can grow business by increasing sales among people already in the market.

Development strategy (internal development: staff expansion, purchase of another business, franchise development;

horizontal integration: expansion strategy that involves the acquisition of another company of the same line of business;

vertical integration: expansion strategy in which one company takes control of one or more stages of production or product distribution).

Sales strategy (internal sales department, distributors, retailers). A sales strategy is a long-term plan for increasing sales. Possible strategic goals include selling to new clients, boosting repeat business or upselling, etc.

PR strategy. A PR strategy helps a business create, organize, and measure the effectiveness of its public relations tactics over time.

A combination of all strategies works best: promotion, advertising, etc.

Once a marketing strategy has been developed, you can begin to define a comprehensive sales strategy, which should include two main elements:

Sales force strategy. Do you plan to have a sales department? If yes, what resources will you use—internal resources or contractors? How many sales managers do you plan to hire? What recruitment strategies will you have? How are you going to train your sales staff? What incentive system will be used?

Sales activities. As you develop your sales strategy, identify specific actions and outline your prospects. Prioritize your existing contacts, selecting those interested in buying first. Then calculate the number of cold calls you need to make in a given period of time. Determine the average number of calls per transaction, the average transaction amount, and the average salesperson’s income.

- Funding

If you are looking for financing, put this section in your business plan to outline your requirements. Contents of the section are: - Current funding requirements

- Any funding requirements that may arise in the next N years

- How do you intend to use the financing you have raised?

- Strategic financial plan for startup business (buyout, business sale, debt repayment, etc.).

When outlining your funding requirements, state the amounts you need now and in the future. The extra sections may involve some analysis and forecasts like:

Financial figures for previous years. If you have an existing business, include three to five previous years of company performance in your business plan. These are profit and loss statements, balance sheets, and cash flow statements.

Financial indicators for the future. Investors are interested in the company’s plans for the coming years. The information for each year should include projected profit and loss statements. Make sure the projections match your funding requests.

Include a brief analysis of financial information in your business plan. It makes sense to visualize the numbers with graphs.

- Guarantees & risks of the company

List all possible threats, identify potential risks and actions that contribute to risk mitigation, and develop an action plan when risks arise to minimize the negative impact on the business. In addition, describe any safeguards the company has. Calculate the financial risk ratio (the ratio of the company’s equity to debt). The closer the ratio is to 0, the more financially independent the firm is.

- Appendix

It is not necessarily a business plan conclusion. The appendix is prepared upon request (if you have materials to include in it). What information is usually included in the appendix: - Credit history

- Summary of key management personnel

- Letters of recommendation

- Market research

- Media presence and expert publications

- Licenses, permits, or patents

- Legal docs

- Copies of lease agreements

- Contracts

- A list of business consultants

Tip: Update your business plan periodically to keep the information up-to-date.

A Template for Writing a Business Plan for a Start-Up

- Briefly about the project. What does the project bring to the market?

1.1.) Why? (Dream, vision, reason, belief, main goal of the business)

1.2) How?

1.3.) A brief description of the essence of the Project

1.4.) A detailed description of the Project

1.5.) Problems to be solved by the Project

1.6.) The Long-Term Objectives of the Project

1.7.) Business concept: an overview of the project/description of the know-how

- Functionality (Technological solution of the project)

2.1.) Brief description of the platform

2.2) Detailed description of the platform

2.3.) Additional modules, services

2.4.) Terms of Reference – web platform

- For whom (Market, users, customers of the project)

3.1.) Portrait of the target audience

3.2.) Characteristics of the target market of similar products/services

- Market structure (size and segmentation) Dynamics

- The most important consumer segments

- Key finding on structure

- Forecast by target market segments

- Key conclusion on the trends of the target segments

- Challenges and needs of the market, the relationship of major market players

- Key conclusion on the key challenges

- Key conclusion on the situation in the target market

- Unique selling proposition (USP)

- Review of the business model

4.1.) Activities

What are the activities of the company?

4.2.) Value to consumers

What is the set of products/services provided to consumers?

What value does the project bring to consumers?

What consumer needs and problems does the project address?

4.3.) Consumer segments

All target customer segments

The most important segments of consumers

4.4.) Resources

What resources are used to create value?

4.5.) Customer Relationships

What types of communications are planned for each customer segment?

What is the level of service?

4.6.) Distribution

- Channels of sales

- Cost of sales channels

- Prioritization of sales channels

4.7.) Partners

- Partners

- Suppliers

- Resources received from partners

- Main activities of partners

4.8.) Structure of expenses

Fixed costs, variable costs

Which resources are the most expensive?

4.9.) Revenue streams

What are consumers willing to pay for?

What payment methods are possible?

Which revenue streams are the most profitable?

4.10.) Basic business processes

5.) Competition. Advantages

5.1.) List of main competitors

5.2.) What do competitors usually offer in the market?

5.3.) What does the project offer?

5.4.) Summary analysis of competitors

5.5.) Best practice analysis

6.) Monetization model for each product

6.1.) Principles of monetization

6.2) Key objectives and methods

6.3.) Number of potential users

6.4) Margins

7.) Strategic potential of the project (why the project will be successful in the future)

8.) Key success factors

8.1.) External factors

8.2.) Internal factors

9.) Project team

9.1.) Key leaders

9.2.) Team

9.3.) Advisors

10.) Project Status

10.1.) Chronology (History of development)

10.2.) Current status (stats on financial and other measurable performance indicators)

10.3.) Achievements to date

11.) Directions for the development of the project. Objectives

12.) Roadmap (Project implementation plan. Major milestones.)

12.1.) Time period

12.2.) Focus

13.) Sales forecast underlying the financial model (Scenarios)

14.) Investment and financial indicators of the project

14.1.) Forecast of net cash flows

14.2.) Necessary volume of investments

14.3.) Payback period

14.4.) IRR

15.) Long-term Investment Strategy (Development/Exit Strategy)

16.) Investment Proposal

16.1.) Conditions of participation

- Project appraisal

- The required amount of investment

- Investor participation

- Budget structure

- Financing

16.2.) Indicators

Annual turnover of the company in 3 years

Valuation of the company in 3 years

16.3.) Financing rounds (tranches)

16.4.) Timing (bids, closing of the transaction)

17.) Financing Model

18.) Marketing. Media plan

19.) Management Model

20.) KPI System

21.) Exit strategy

22.) Legal Aspects

22.) Miscellaneous

How Much Does a Business Plan Cost?

Specialists in writing business plans have a large database of ready-made business plans. In addition, at your request, they can create a plan that takes into account all your wishes and concerns. The cost of a business plan depends on the amount of work and the amount of investment.

The average price of business plans falls within $2,000-$25,000. The turnaround time takes from 10 days. If you need a business plan urgently (1-3 days), you will have to pay an extra fee.

Keep in mind that it is not enough to hire a good copywriter to receive a robust business or marketing plan. You need a field expert who has also mastered other fields, such as corporate finance. IntelliSoft can help you finish your business plan and implement the idea. Do not mind turning to us even if some points in your plan are missing—we’ll try to figure it out!

Conclusion

Creating a business plan for a tech start-up is vital and usually takes place before hiring developers to build a product’s MVP. Without a good business plan, a tech start-up might fail due to poor organization and lack of financing. This document requires in-depth market analysis and financial forecasts. The idea is to make your project attractive to potential partners and investors.

You may write a plan on your own or hire experts to do that. In any case, once you have a detailed description of how you see your product or service, experts from IntelliSoft can start working on your project and consult you on any missing parts. Learn more by contacting us now!